- XRP was down by greater than 4% within the final seven days.

- Most market indicators remained bearish on the token.

Like most cryptos, XRP was additionally going through hassle of late because it failed to boost its value. The most recent value correction has pushed XRP right down to a vital assist degree.

This allowed the token to make a bullish transfer to alter the development. Nevertheless, if the token fails to check the assist, then issues can worsen.

XRP bears are main

CoinMarketCap’s knowledge revealed that XRP’s worth dropped by greater than 4% within the final seven days. Within the final 24 hours alone, its value dipped by over 2%.

On the time of writing, the token was buying and selling at $0.4754 with a market capitalization of over $26 billion, making it the seventh largest crypto.

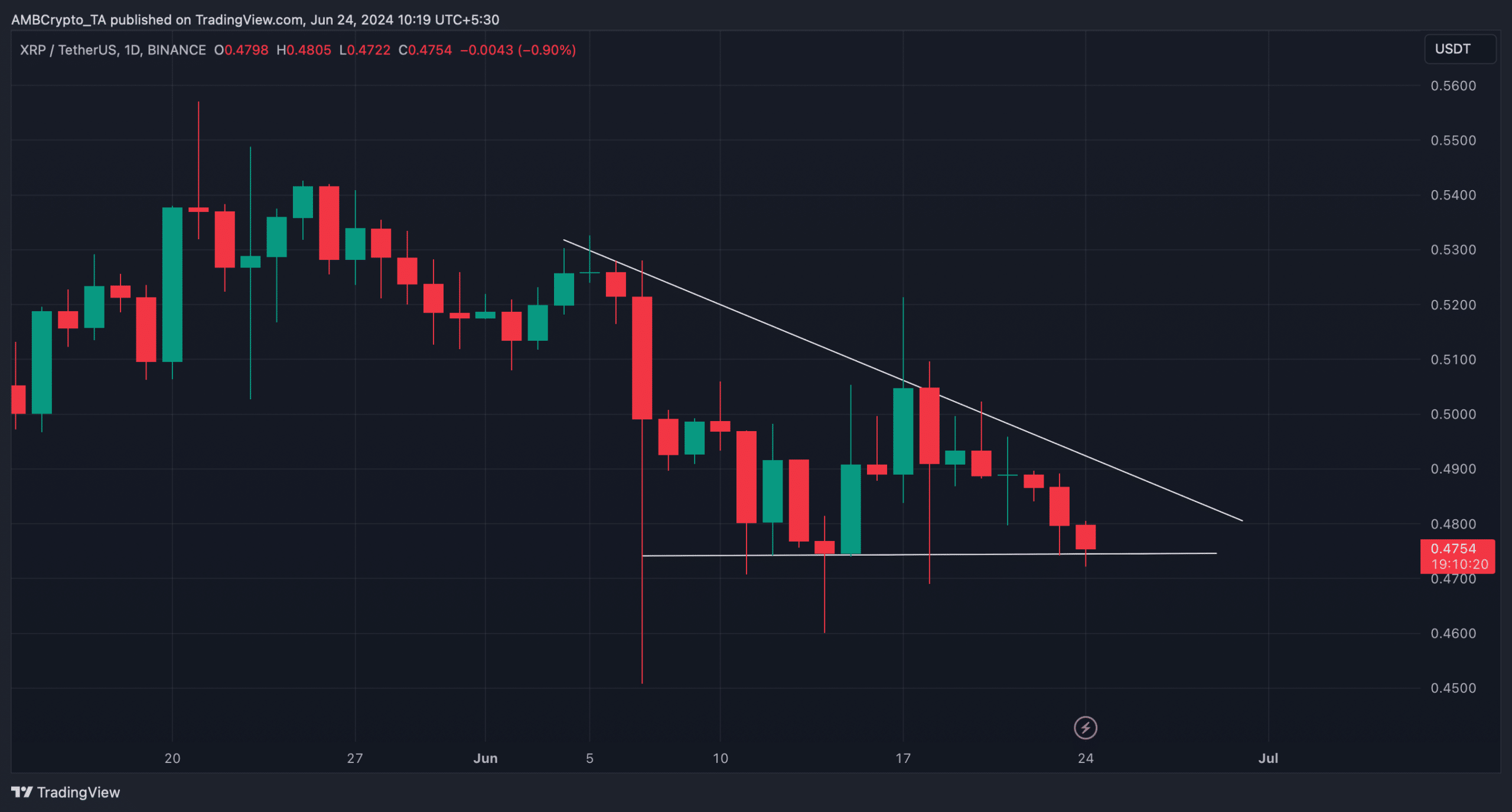

AMBCrypto’s evaluation of the token’s day by day chart revealed {that a} descending triangle sample appeared.

In truth, the token was testing its essential assist zone, which gave XRP a chance to rebound. But when it fails to check the assist, then buyers may witness an additional value decline within the coming days.

Supply: TradingView

What to anticipate?

Since there was uncertainty about XRP within the coming days, AMBCrypto deliberate to take a look on the token’s on-chain knowledge.

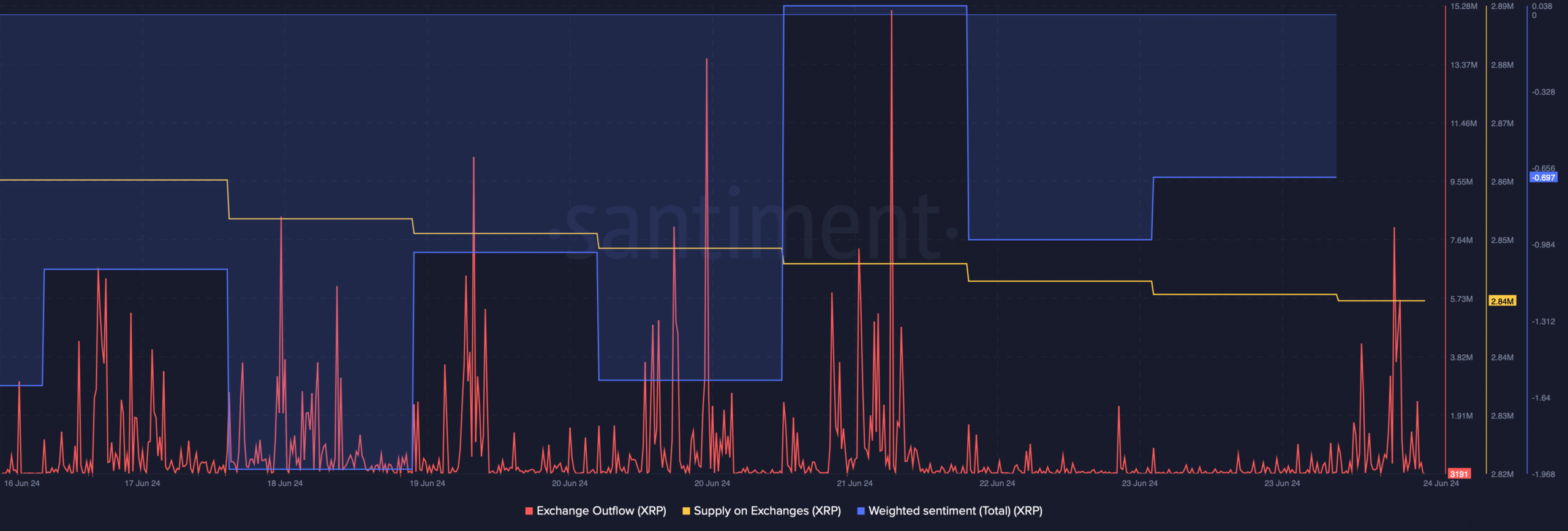

Our evaluation of Santiment’s knowledge revealed that purchasing stress on XRP was rising. This was evident from the spikes in its change outflow final week.

On prime of that, its provide on exchanges additionally dropped, that means that buyers had been shopping for the token,

After an enormous dip, the token’s weighted sentiment additionally improved. An increase within the metric implies that buyers had been assured in XRP and bullish sentiment across the token was growing.

Supply: Santiment

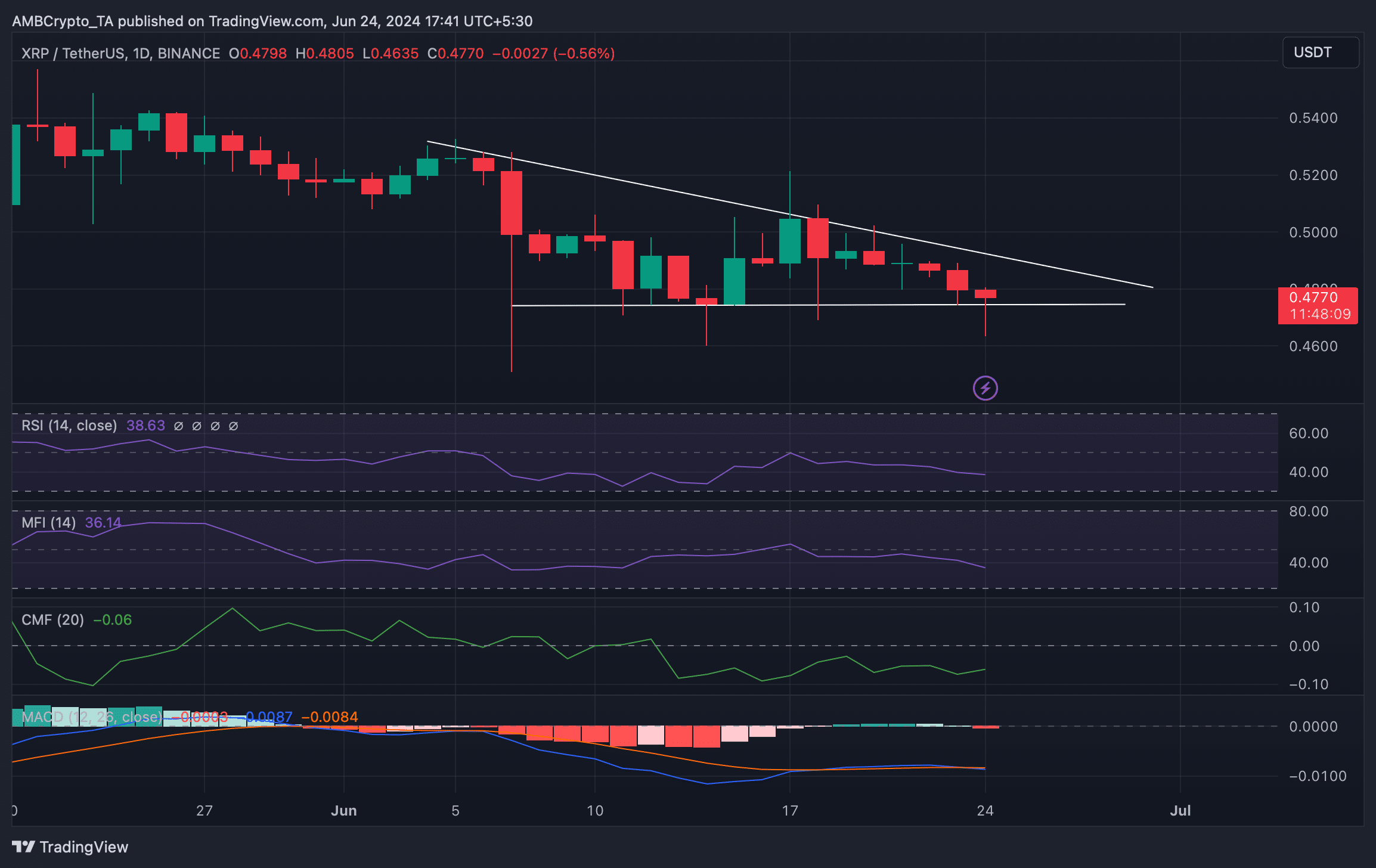

The token’s Chaikin Cash Stream (CMF) additionally seemed optimistic because it registered an uptick. Nevertheless, the remainder of the indications seemed bearish, suggesting that XRP may plummet below its assist.

Each its Relative Power Index (RSI) and Cash Stream Index (MFI) registered downticks. Moreover, the MACD dispelled the concept that the bulls and the bears had been in a battle to achieve a bonus over one another.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the XRP Revenue Calculator

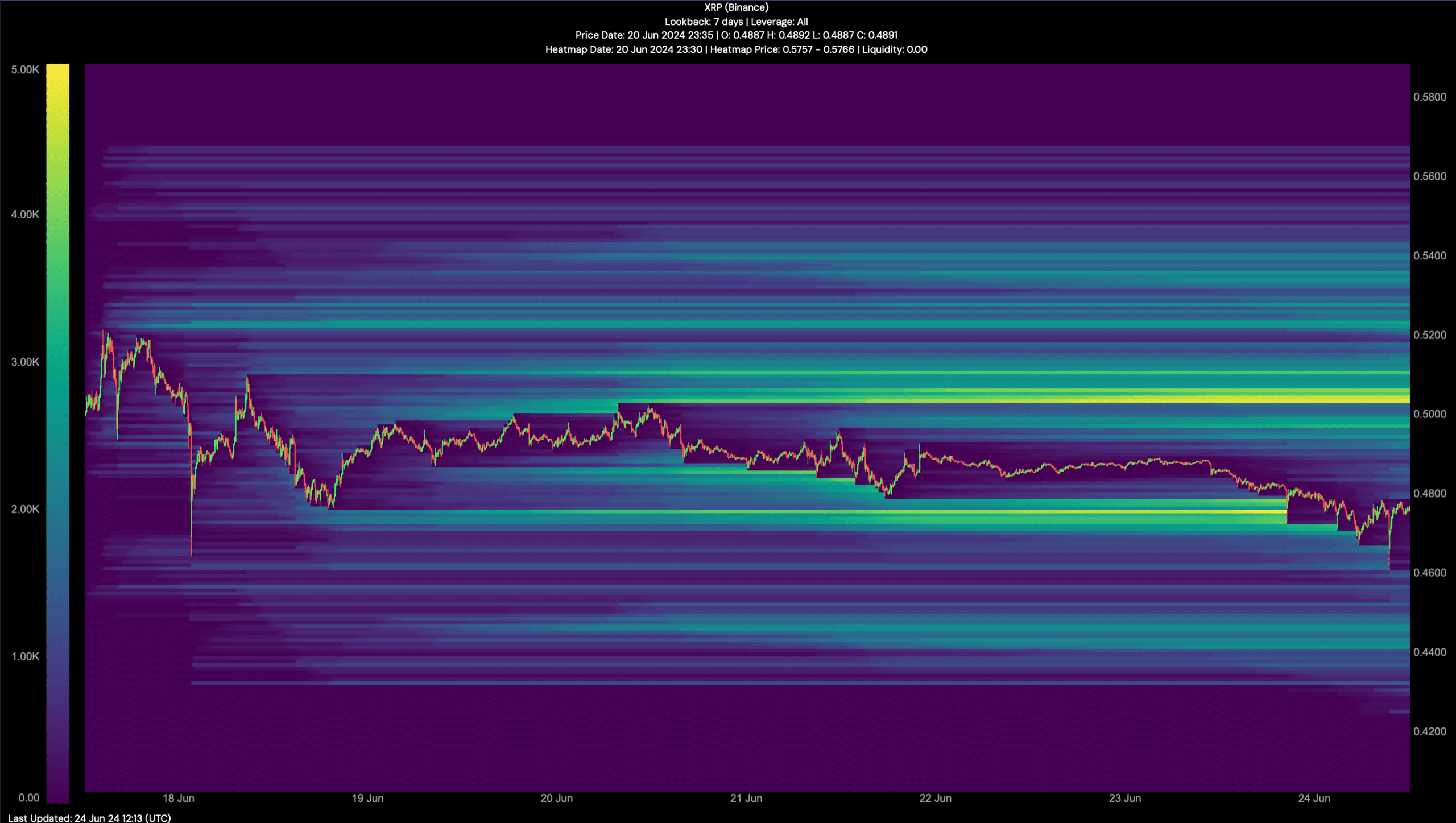

We then checked Hyblock Capital’s knowledge to search for upcoming targets for XRP this week. As per our evaluation, the bears proceed to dominate.

Then buyers may see the token drop to $0.445 this week. Nevertheless, if the bulls step in and provoke a development reversal, then the token may as properly reclaim $0.5 as liquidation would rise at that degree.

Supply: Hyblock Capital