- MATIC could also be due for a double-digit rally, based on analyst Ali Martinez.

- Nevertheless, it would face headwinds within the quick time period.

Polygon (MATIC) is due for a 17% worth rally if it breaks above its parallel channel, crypto analyst Ali Martinez has famous in a publish on X (previously Twitter).

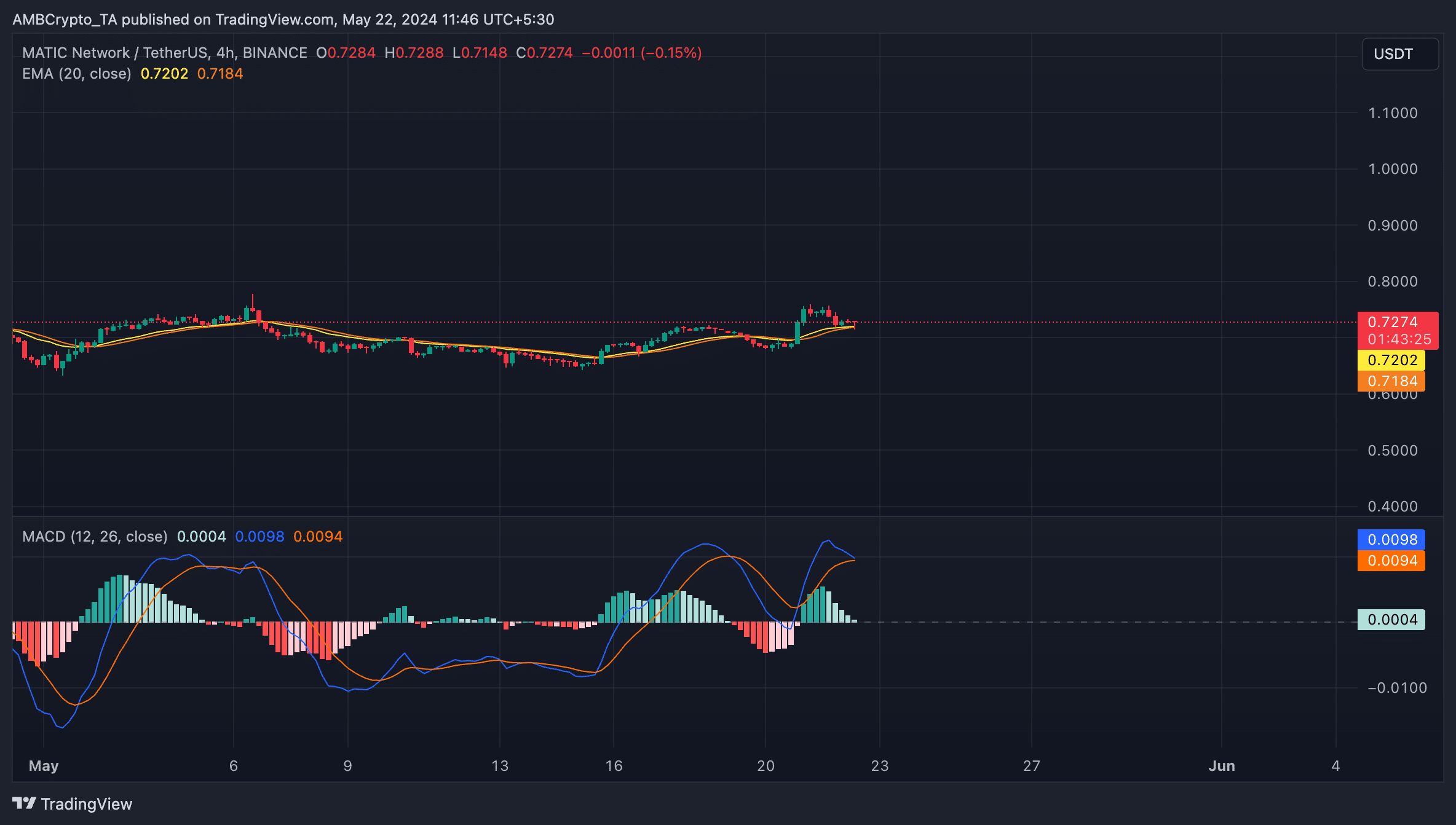

Assessing the L2 token’s actions on a 4-hour chart, Martinez discovered that its worth has consolidated inside a spread because the starting of April to kind the parallel channel sample.

This sample is shaped when an asset’s worth motion is confined between two pattern traces, indicating a interval of consolidation.

MATIC might not be prepared

At press time, MATIC exchanged fingers at $0.72 and trended in direction of the higher line of its parallel channel.

When an asset rallies towards the higher trendline of a parallel channel, it’s interpreted as an try to check resistance.

If that place fails to carry, and a breakout ensues, the asset in query could document new worth highs.

Nevertheless, AMBCrypto discovered that MATIC’s rally above this resistance degree could also be difficult within the quick time period.

It is because the token’s worth trades considerably near its 20-day Exponential Transferring Common (EMA).

When an asset’s worth fluctuates round this transferring common, it hints at indecision available in the market, with neither patrons nor sellers capable of set up dominance.

For a break above the resistance to happen, there needs to be a surge in shopping for stress, which places the bulls in clear market management.

Nevertheless, with MATIC’s MACD line (blue) gearing to fall beneath its sign line (orange), bear energy could be on the rise.

When an asset’s MACD line makes an attempt to fall beneath its sign line, it is typically interpreted as a bearish sign. It suggests a weakening upward momentum and a shift in direction of a downtrend.

Supply: MATIC/USDT on TradingView

An excellent place to purchase?

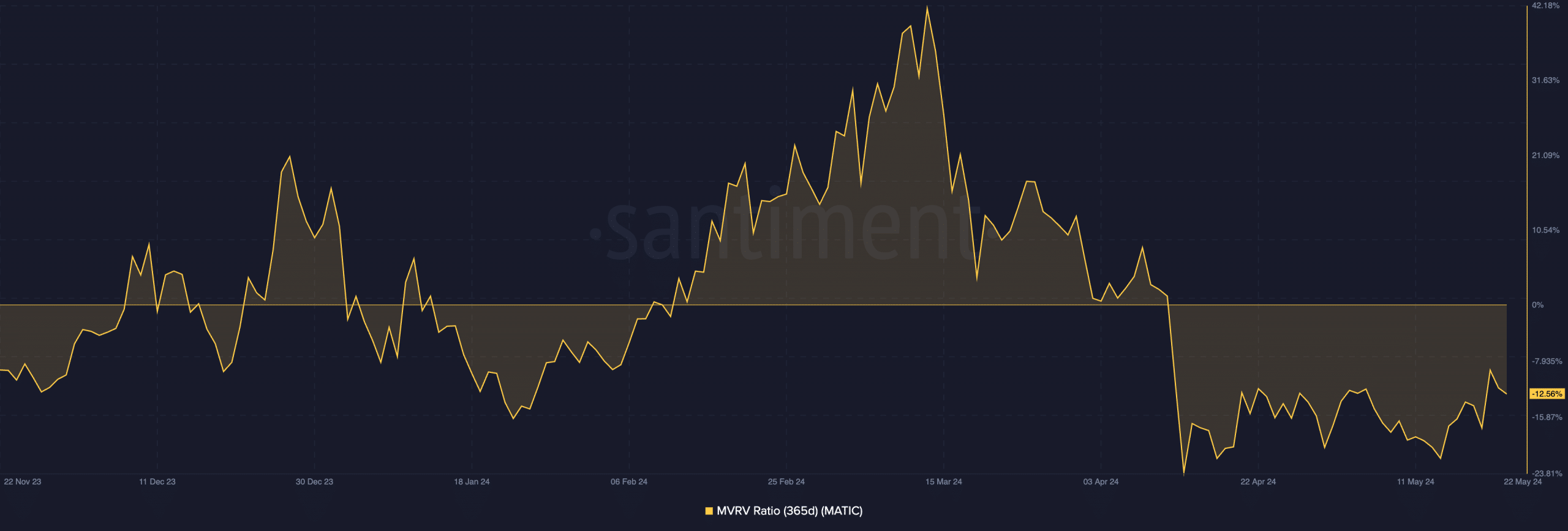

MATIC’s Market Worth to Realized Worth (MVRV) ratio, assessed utilizing a 365-day transferring common, has flashed a purchase sign.

Based on Santiment’s information, this metric’s worth was -12.58% as of this writing. The metric measures the ratio between MATIC’s present market worth and the common worth of each token acquired.

Supply: Santiment

Learn Polygon’s (MATIC) Value Prediction 2024-2025

When it returns a unfavourable worth like this, MATIC is deemed to be undervalued, as its market worth is beneath the common buy worth of all its tokens in circulation.

It’s seen as a purchase sign as a result of merchants see it as a possibility to purchase the token at a reduction in comparison with the historic price foundation.