J. Scott Davis and Pon Sagnanert

The buying energy parity (PPP) principle of trade charges is definitely understood: A basket of products ought to have the identical worth in numerous markets when that worth is expressed in a typical forex. This assumes particular person trade charges, absent market frictions, can freely regulate to take care of parity.

Intuitively, the forex of nation A can be anticipated to finally depreciate in opposition to nation B’s forex in response to higher-than-expected inflation in nation A. Buyers enhance their expectations in regards to the long-run worth stage in nation A, and thus the forex of nation A should depreciate to make sure that the worth of a basket of products within the two nations stays the identical when expressed when it comes to a typical forex.

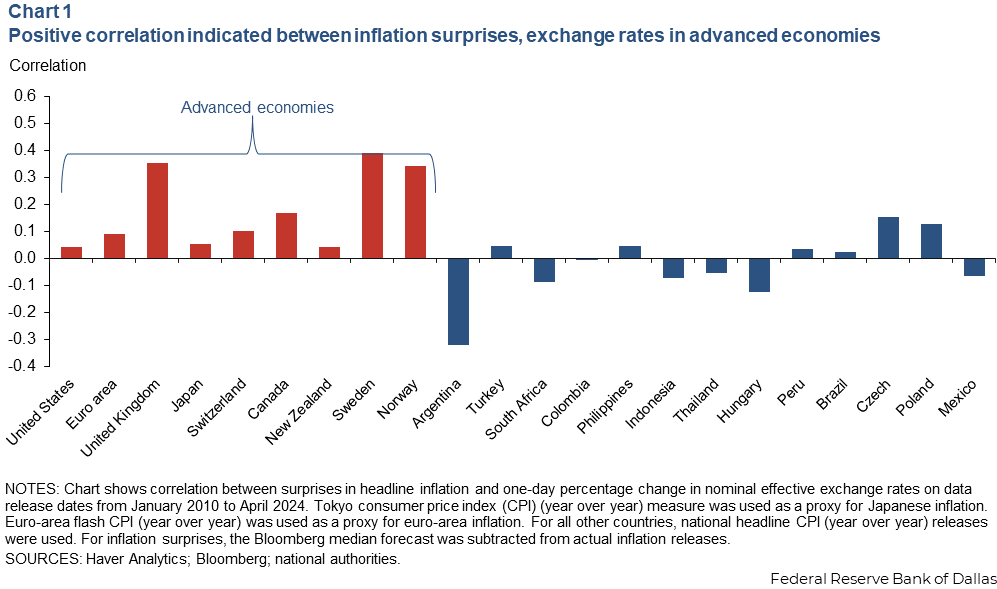

Nevertheless, the connection between market-determined trade charges and inflation shocks just isn’t simple within the brief run. In superior economies, trade charges admire in opposition to a basket of its main commerce companions’ currencies on days when higher-than-expected inflation surprises happen. This consequence appears to distinction with what the PPP principle predicts.

Moreover, the correlations are blended in rising markets, suggesting that superior and rising markets reply otherwise to information about inflation shocks (Chart 1).

Central financial institution coverage response impacts market habits

Economists Richard Clarida (Federal Reserve vice chairman in 2018–22) and Daniel Waldman supplied a theoretical framework in a 2007 paper, “Is Unhealthy Information About Inflation Good Information for the Alternate Price?” The authors try to elucidate how “dangerous information” about inflation (higher-than-expected inflation) might be “excellent news” for the nominal trade charge (an appreciation) as buyers contemplate how central banks may react to the upper inflation.

Empirically, they discovered important variations in overseas trade market response in nations with formal inflation focusing on regimes, in contrast with nations missing formal targets.

If buyers imagine that the central financial institution will react to an inflation shock by elevating the coverage charge, then the shock is not going to change beliefs in regards to the long-run worth stage, however it’ll alter expectations in regards to the coverage charge within the close to time period. The upper rate of interest makes a rustic’s belongings extra engaging, resulting in capital inflows that admire the forex. If expectations in regards to the long-run worth stage are unchanged, there is no such thing as a motive for the trade charge to depreciate to make sure PPP.

Thus, the response of the trade charge to an inflation shock ought to rely upon beliefs in regards to the central financial institution response.

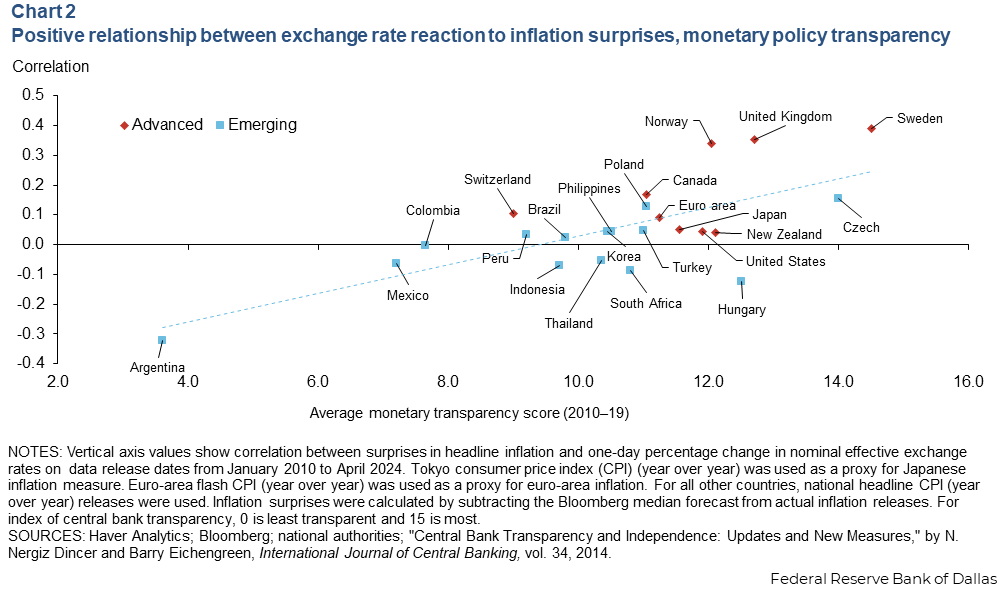

N. Nergiz Dincer and Barry Eichengreen compiled a measure of central financial institution transparency, the place central banks are assigned a rating from 0 to fifteen primarily based on the readability of financial institution coverage goals and operations (15 being the best rating on the financial coverage transparency index). We are able to evaluate the correlations in Chart 1 to those transparency scores to see if more-transparent central banks additionally are likely to have currencies that admire following an inflation shock (Chart 2).

The scatterplot exhibits a powerful optimistic relationship between the overseas trade market response to shock inflation and financial coverage transparency within the cross-country pattern.

In different phrases, an trade charge tends to understand in response to an upside shock in inflation in nations with larger financial coverage transparency, as markets consider presumed central financial institution response—the upper the transparency rating, the stronger the forex appreciation.

A regression of the correlation between an inflation shock and the trade charge on the central financial institution transparency rating has a coefficient of willpower (R-squared) of 0.48. Extra merely, the extent of central financial institution transparency explains 48 % of the cross-country variation within the correlation between the trade charge and inflation surprises.

A better stage of financial coverage transparency is one motive superior economies’ correlations are usually optimistic, whereas some nations with decrease scores expertise exchange-rate depreciation in response to a higher-than-expected inflation shock.

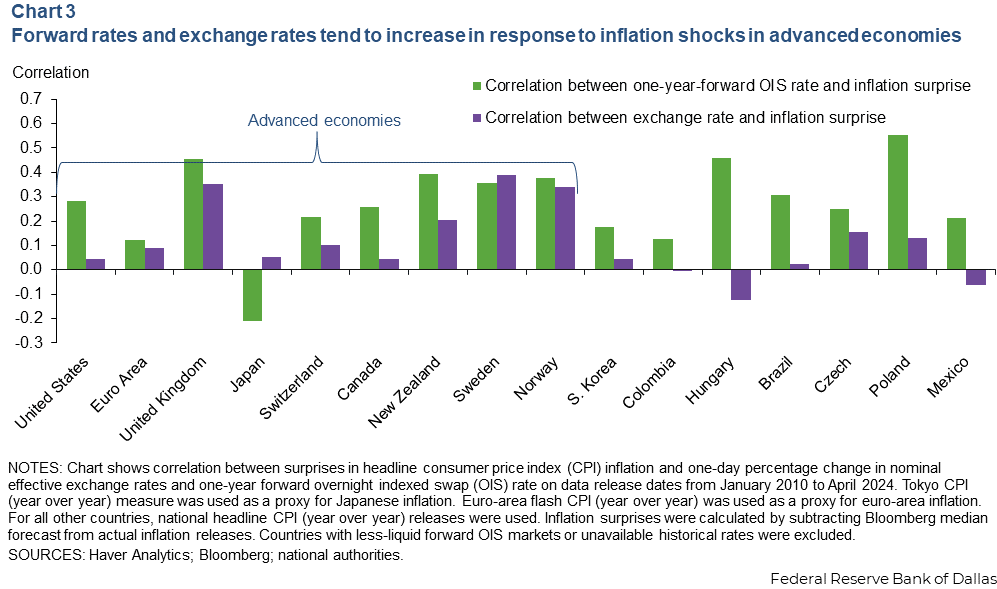

Drawing on one other indicator, market expectation of central financial institution response to an inflation shock might be inferred from the one-year-forward in a single day listed swap (OIS) charge, a market-implied proxy for the place the coverage charge can be one 12 months from now. Correlations between inflation surprises and the change in one-year-forward OIS might be instructive.

Chart 3 compares the correlation, calculated from 2010 to April 2024, between the inflation shock and the trade charge. It individually depicts the correlation between the inflation shock and the one-year-forward charge.

For a lot of rising markets, the correlation of the inflation shock with the ahead charge is simply as excessive as in superior economies, whereas the correlation of the inflation shock with the nominal efficient trade charge is way decrease. Thus, in superior economies, each ahead charges and the trade charges have a tendency to extend in response to inflation shocks. However in rising markets, the ahead charges enhance however will not be essentially accompanied by an appreciation of the trade charges amid inflation shocks.

In principle, a rise within the anticipated future coverage charge ought to result in widened rate of interest differentials, all else equal. This is a crucial determinant of a forex’s energy within the brief run.

However in some rising markets, during which the central banks are likely to have a decrease financial coverage transparency rating (which might indicate that the central banks’ inflation targets are much less credible), “dangerous information” on inflation could also be perceived by market members as contributing to a rise in inflation threat premium, which could lead on buyers to scale back exposures to the nation’s bond market, and a depreciation of the forex in keeping with the PPP principle.

Increased inflation setting influenced market response to shocks

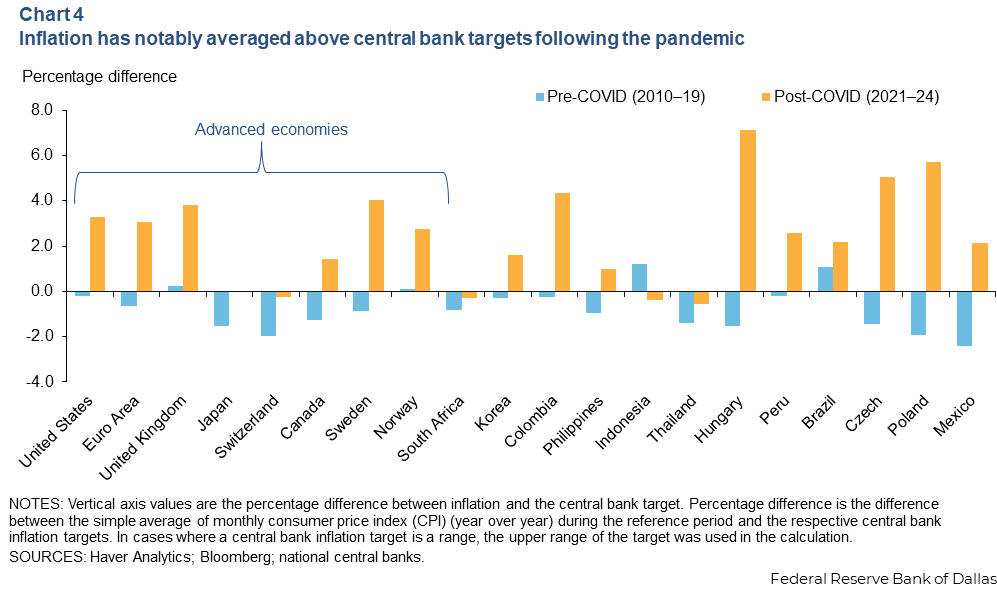

A central financial institution response operate just isn’t static and infrequently relies on the macroeconomic setting during which the central financial institution operates. Chart 4 assesses a rustic’s inflation efficiency in opposition to its central financial institution’s goal, exhibiting the distinction between the typical month-to-month inflation (12 months over 12 months) and the central financial institution’s inflation goal. (In circumstances the place a central financial institution’s goal is a variety, we used the higher sure of the goal vary. We additionally excluded nations with out formal inflation targets and a few outliers, similar to Turkey and Argentina).

With a couple of exceptions, inflation averaged close to or nicely beneath central banks’ inflation targets earlier than the pandemic, from 2010 to 2019. Because the pandemic (we used information from January 2021 by means of June 2024), 15 of 20 nations skilled notably above-target inflation, and for the nations with nonetheless below-target inflation, the gaps between common inflation and their inflation goal narrowed significantly.

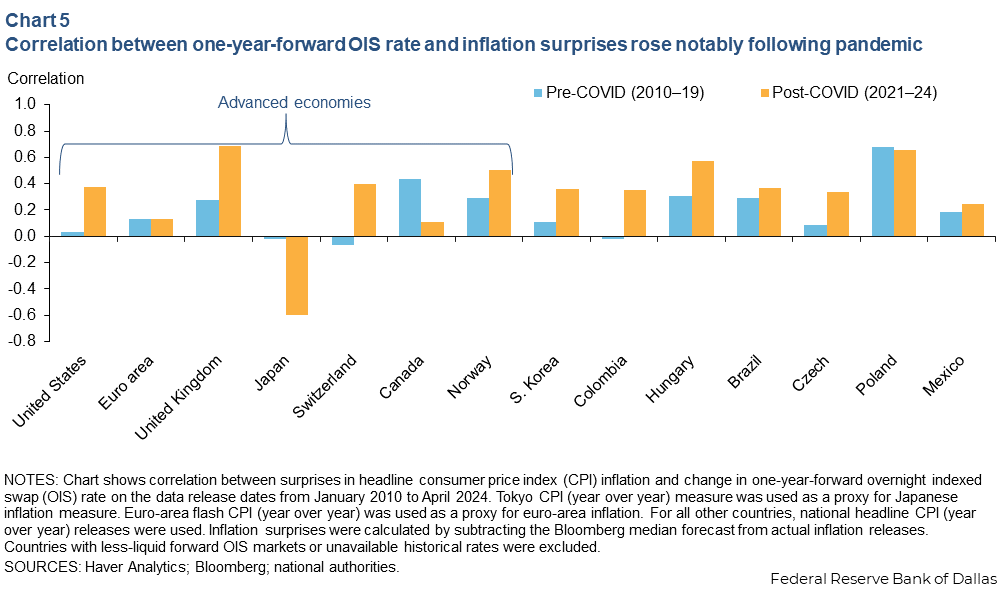

Certainly, Chart 5 exhibits the correlation between the one-year-forward charge and the inflation shock within the pre- and post-COVID intervals.

In a lower-inflation setting earlier than the pandemic, many central banks, together with the Federal Reserve, appeared considerably insensitive to inflation shocks. Subdued worth pressures following the International Monetary Disaster had restricted upside inflation dangers. In the meantime, the coverage charges in lots of superior economies had been pinned at or close to the efficient decrease sure—basically a 0 % coverage charge. Thus, there was restricted room for coverage charges to react to draw back inflation surprises. In consequence, the correlations between inflation surprises and the one-year-forward charge had been low and even detrimental.

Nevertheless, this correlation has elevated notably for many nations as their central banks launched into a coverage tightening marketing campaign, boosting charges to curb surging world inflation in the course of the pandemic. Increased inflation and a motion of coverage charges away from the efficient decrease sure has meant that coverage charges react extra forcefully to inflation surprises.

As inflation normalizes towards central financial institution targets, dangers to the inflation outlook and central banks’ response capabilities ought to change into extra balanced (with each upside and draw back dangers). Thus, it’s probably that ahead charges (market-implied central financial institution response) and trade charges will proceed reacting to inflation surprises, particularly when involving central banks whose inflation targets are deemed comparatively extra credible.

Concerning the authors

The views expressed are these of the authors and shouldn’t be attributed to the Federal Reserve Financial institution of Dallas or the Federal Reserve System.