- Athena maintained a better timeframe bearish development.

- The shopping for strain was not commensurate with the momentum shift.

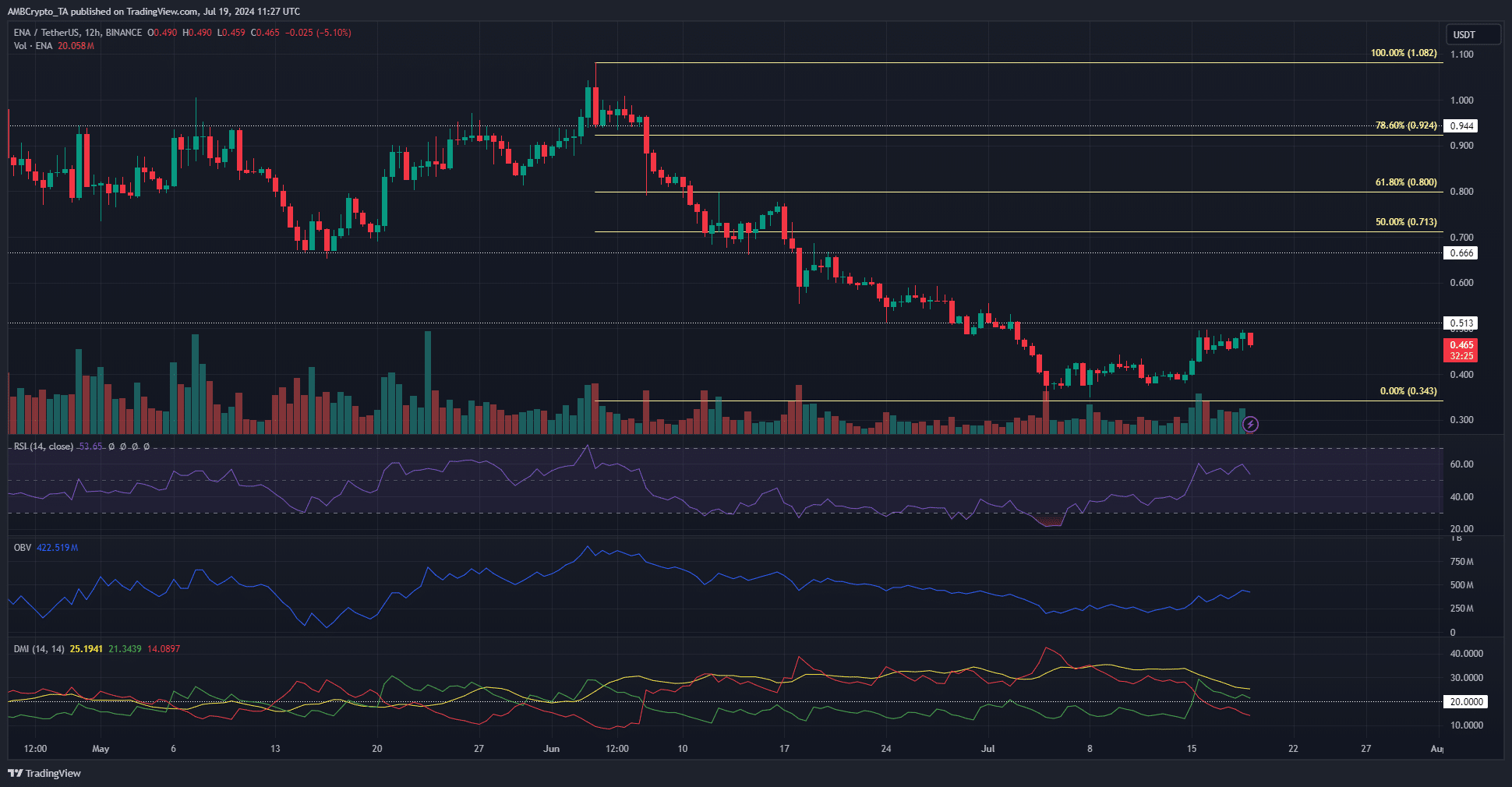

After the losses famous within the first week of July, Athena (ENA) managed to bounce by 44.9% from the $0.343 low on the fifth of July to the $0.497 excessive on the 18th of July.

It was an encouraging begin for the bulls, however not sufficient to flip the upper timeframe downtrend.

The psychological $0.5 mark acted as assist towards the tip of June however can be resistance for ENA on the way in which up. Can the patrons flip this stage to assist?

The bullish prospects of Athena

Supply: ENA/USDT on TradingView

The RSI on the 12-hour chart rose above impartial 50 on the fifteenth of July. This was an early signal of the altering momentum.

The Directional Motion Index additionally noticed the +DI (inexperienced) crossover above the -DI (crimson) to point out a possible development shift.

Nonetheless, a transparent uptrend will not be but in sight. The latest decrease excessive at $0.443 has been overwhelmed. This was a market construction shift, as Athena has fashioned increased lows over the previous few days.

A transfer previous the $0.5 provide zone is required to alter the long-term investor sentiment. The OBV is starting to climb increased, which is one other constructive sign of shopping for strain.

Merchants should be ready for a rejection from $0.55 after the liquidity is examined.

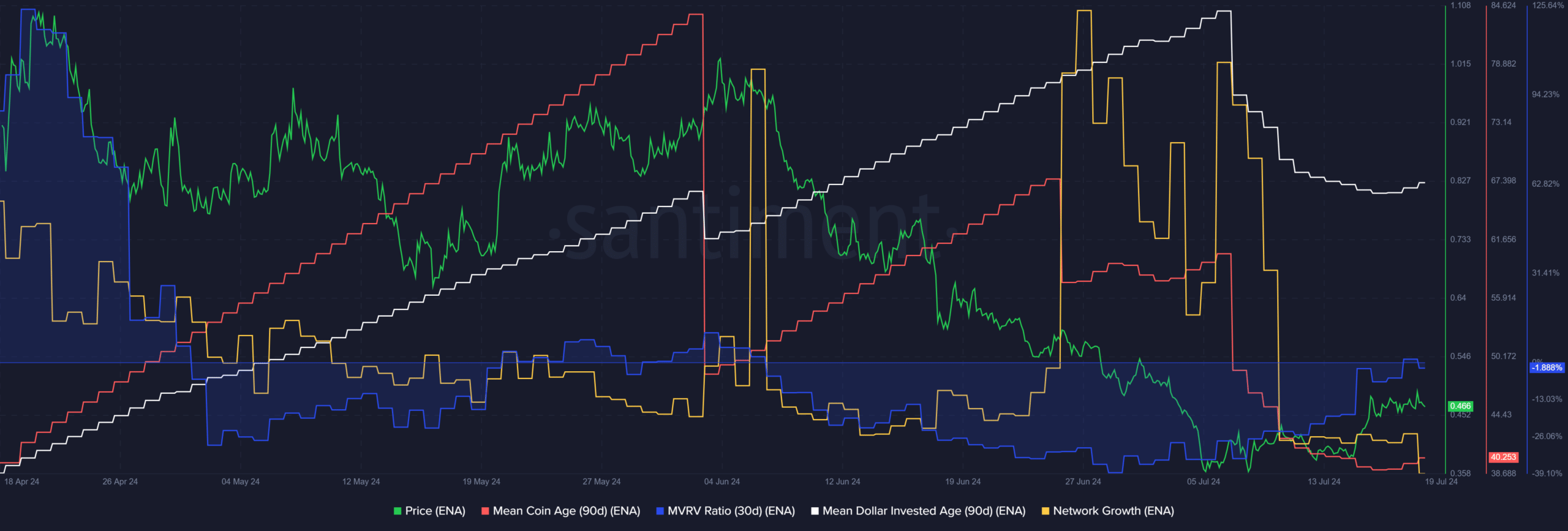

Community development spiked earlier than the value restoration started

Supply: Santiment

The 30-day MVRV ratio was at -1.88%, which confirmed short-term holders had been struggling a minor loss. The restoration of the short-term MVRV is not shocking after the value bounce of the previous two weeks.

The shock was from the robust downtrend of the imply coin age, which signaled a distribution part.

Is your portfolio inexperienced? Verify the ENA Revenue Calculator

The falling imply greenback invested age implied an elevated community exercise and cash flowing again into circulation, which was bullish.

General, the metrics had been bearish for Athena. The proof at hand doesn’t assist a robust breakout previous the $0.5-$0.55 resistance.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.