- Avalanche and Aptos touted to be subsequent in line for ETF approval

- Each tokens noticed their costs fall considerably over the previous couple of days

The approval of ETFs and the anticipation surrounding the decision has helped the costs of each BTC and ETH. Nevertheless, there’s a chance that the surges in value won’t be restricted to the blue chip cash align.

In reality, Avalanche (AVAX) and Aptos (APT) have now been cited as cryptocurrencies which may be a part of the membership, if firms select to file them.

Will Avalanche and Aptos be subsequent?

In line with information shared by GSR, Avalanche and Aptos have a better probability of getting their ETFs accredited, supplied the Solana ETF utility will get approval.

GSR’s research revealed that regulatory our bodies just like the SEC are displaying indicators of openness in direction of spot ETFs for cryptocurrencies that meet particular standards. This can be a vital shift, in comparison the way it has been over the previous couple of years.

Decentralization and potential investor demand are seen as key components. The next stage of decentralization, which means a community not managed by a single entity, is prone to be considered favorably for ETF approval. Metrics like Nakamoto Coefficient, Staking Necessities, and CCData Governance Score will help assess this.

Amongst different cryptocurrencies, Avalanche and Aptos have a very good probability of getting ETF approval as a consequence of their comparatively decentralized constructions in accordance with GSR.

Even with a excessive decentralization rating, an ETF is unlikely if there’s not sufficient investor curiosity although. Ergo, issuers will weigh each components when deciding which cryptocurrencies to pursue for ETFs.

ETF approval would make Avalanche and Aptos extra accessible to mainstream traders who could be hesitant to straight purchase cryptocurrencies on exchanges. This might considerably enhance their person base and adoption.

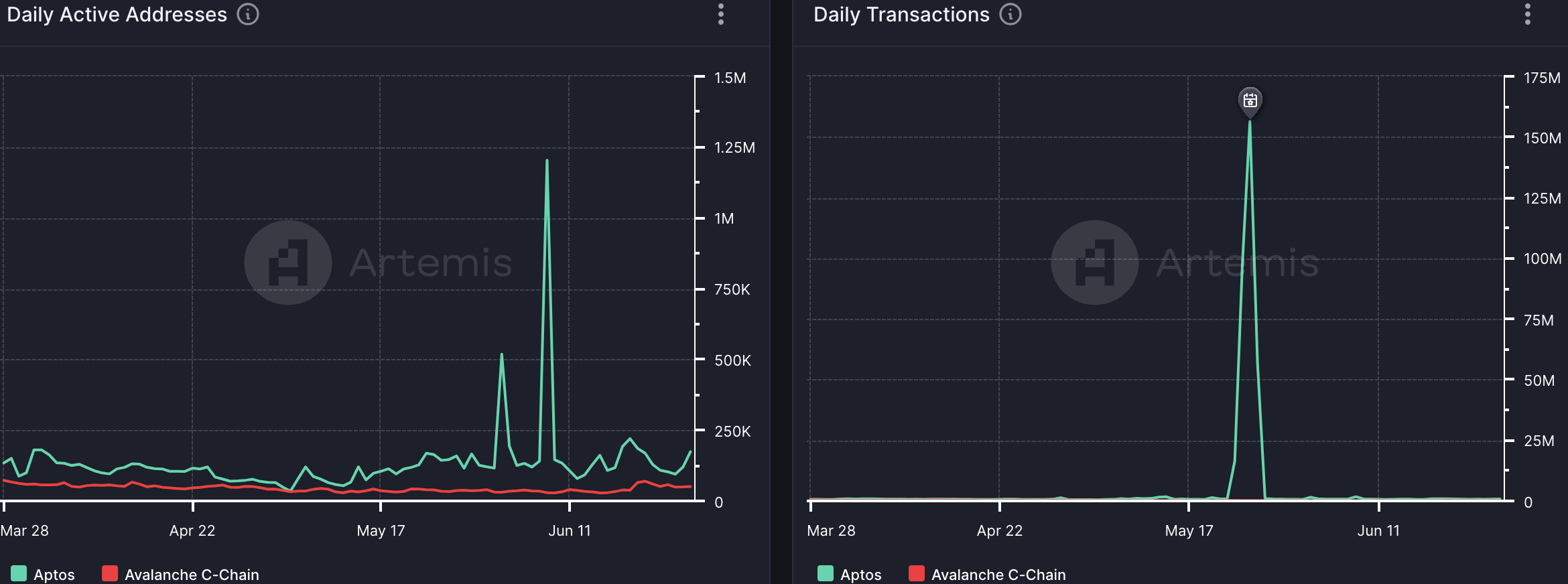

Nevertheless, on the time of writing, issues have been trying bleak for each the protocols. Each day exercise on each protocols and transactions declined materially over the previous couple of days. Furthermore, the TVL (Complete Worth Locked) fell throughout the board, implying that the protocols’ efficiency was not constructive within the DeFi sector.

Supply: Artemis

How are the tokens working?

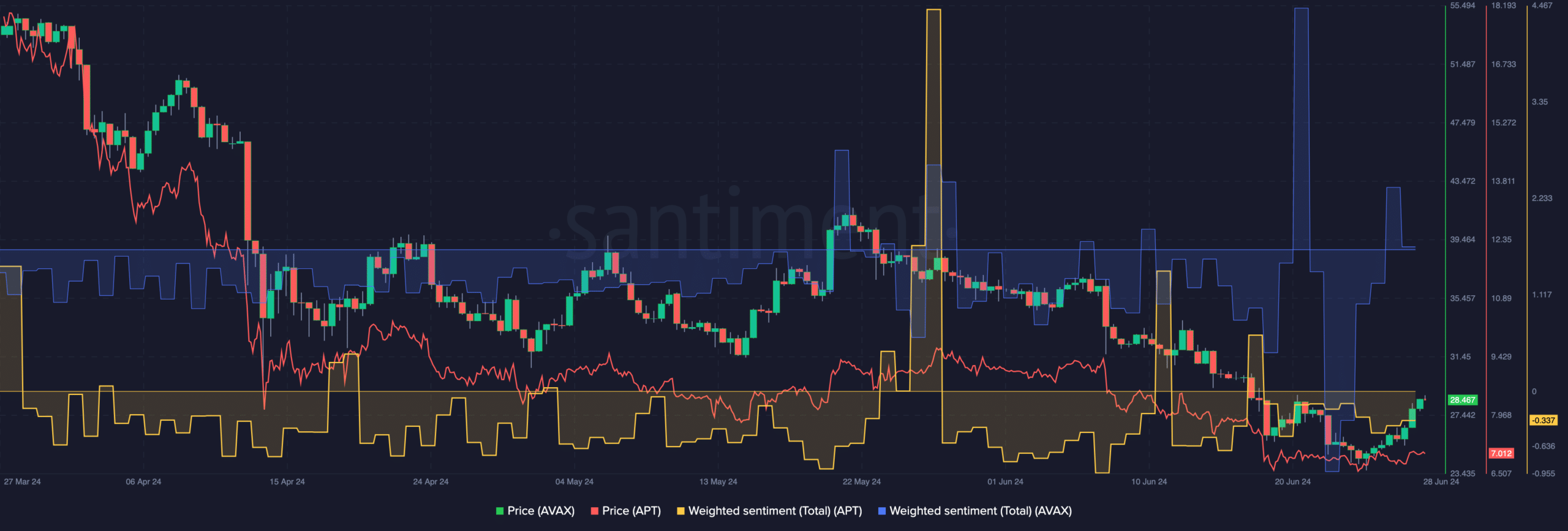

The value actions of each these tokens witnessed a major decline over the previous months, displaying indicators of a bearish development.

Nevertheless, whereas weighted sentiment round APTOS fell considerably over the previous couple of days, the sentiment round AVAX surged.

Real looking or not, this is AVAX market cap in BTC’s phrases

Supply: Santiment