- Drop in charges alerts a difficult interval for the community’s profitability

- Provide on exchanges fell, with different developments supporting a worth hike

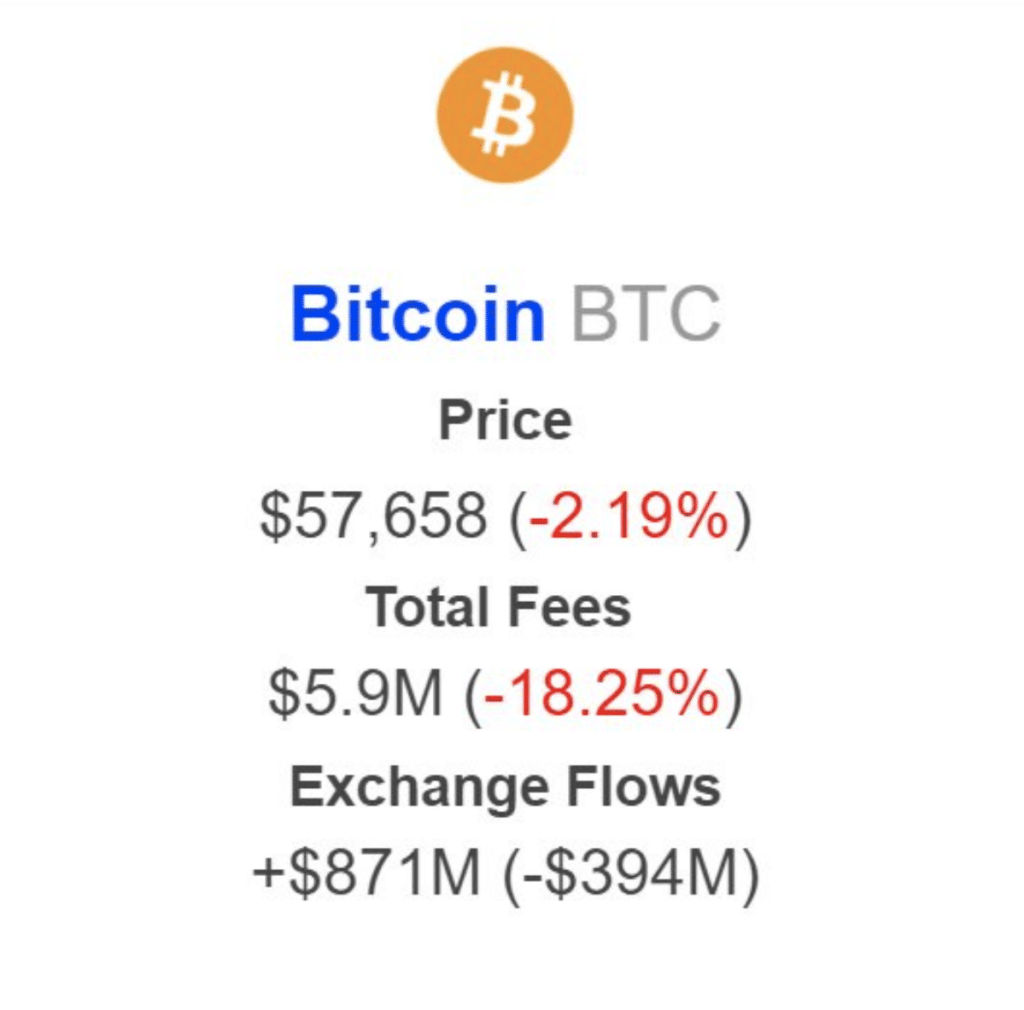

The whole charges generated by the Bitcoin (BTC) community fell by 18.25%, in comparison with the earlier week’s worth. In line with IntoTheBlock, Bitcoin made solely $5.90 million.

Nonetheless, that was not the one factor. The decline additionally meant that the community registered the bottom charges since November 2023.

Decrease transactions equal decrease charges

For these unfamiliar, the buying and selling quantity of Bitcoin often determines how a lot in charges the community makes. If quantity is excessive, it means consumer demand for block house would enhance.

Due to this fact, miners would be capable to validate new blocks whereas making income. The final time such a factor occurred was through the halving when the Runes protocol got here into play.

Supply: IntoTheBlock

On the time, charges spiked and miners’ profitability hit a excessive level. Alas, in current occasions, that has not been the case, with BTC’s worth being one of many culprits.

At press time, Bitcoin’s worth was $58,135. Earlier than its most-recent hike, the coin was buying and selling at a degree as little as $54,832, whereas battling falling curiosity and low demand.

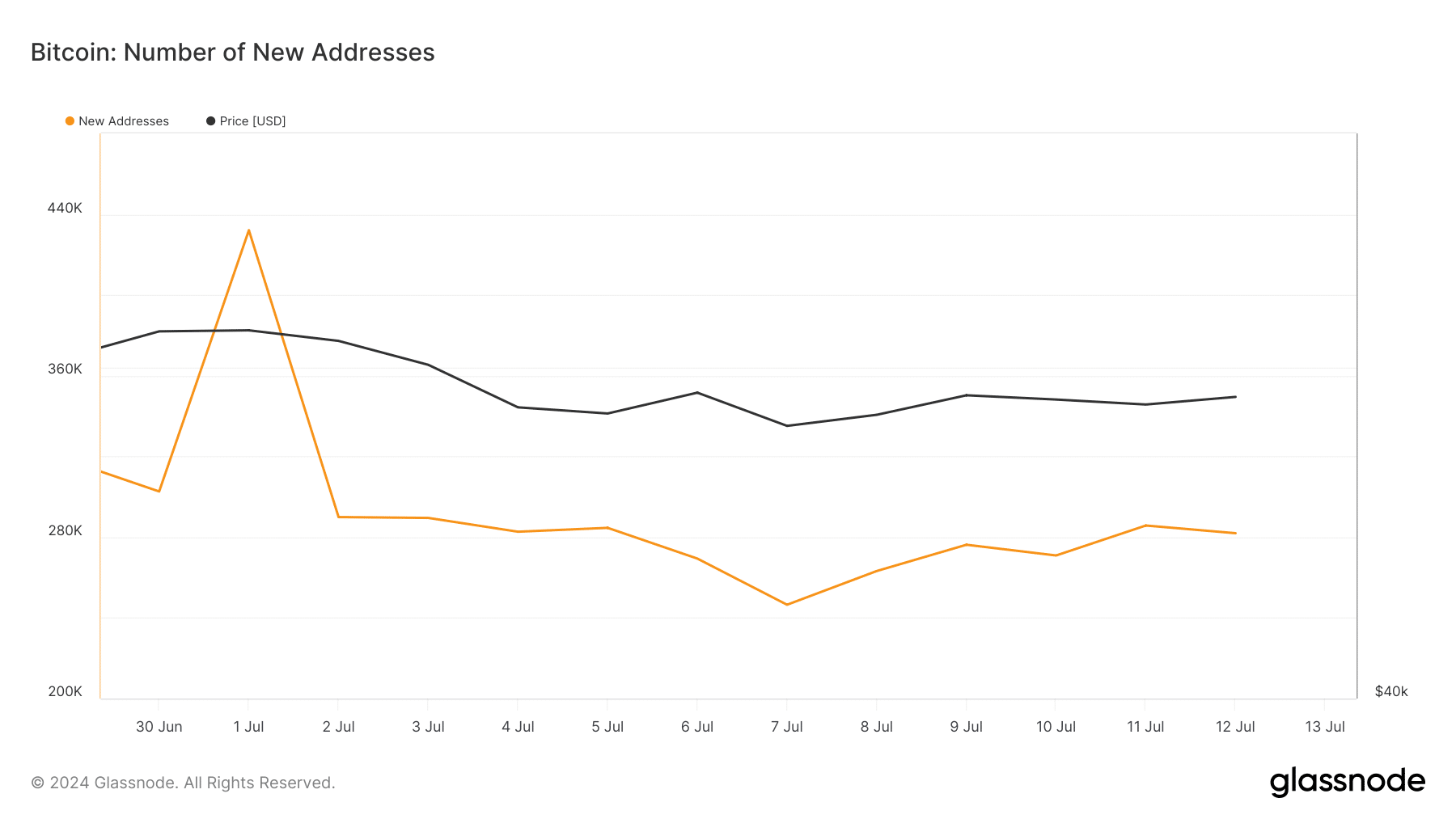

AMBCrypto discovered proof of the low demand by trying on the variety of new addresses. In line with Glassnode, the variety of new Bitcoin addresses on 12 July was simply 289,915. In direction of the start of the month, nonetheless, this similar metric stood at 432,026.

This decline implies that there was a drop in first time transactions made by distinctive addresses on the community.

Supply: Glassnode

BTC set to stroll its approach again up

If this determine continues to fall, it could not be inevitable to file one other decline in Bitcoin charges. Nonetheless, if a leap happens within the coming weeks, the community would possibly make extra income and BTC’s worth may also admire.

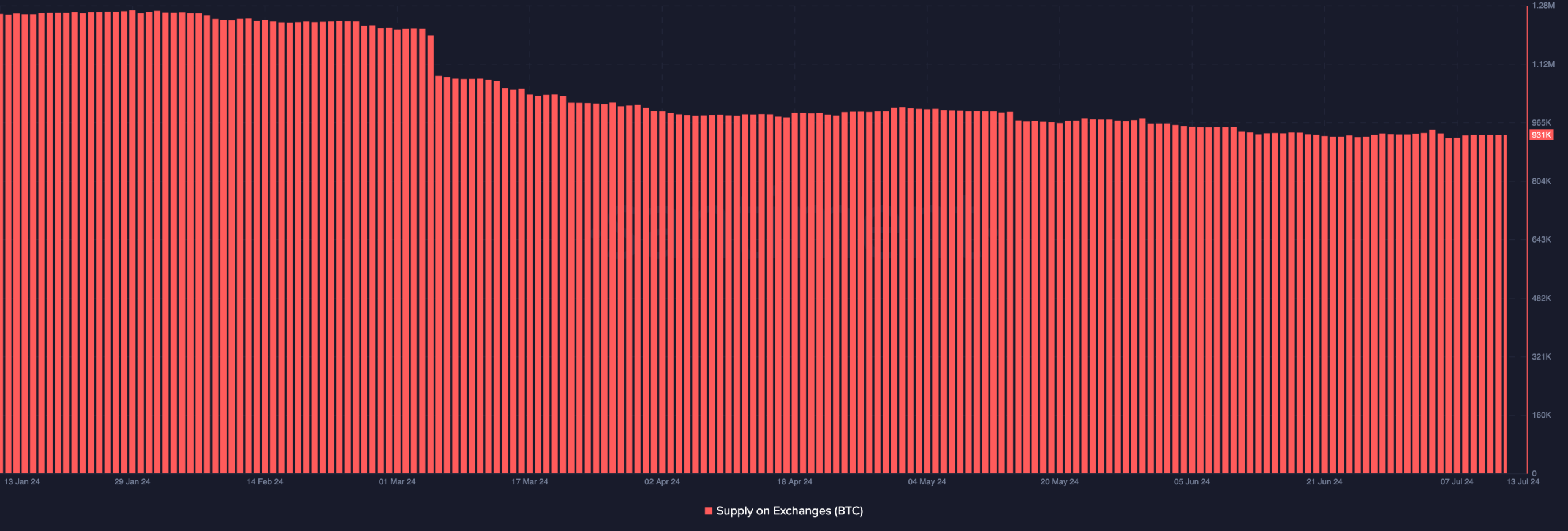

Moreover, we seemed on the provide on exchanges. When the provision on exchanges will increase, it implies that holders are more than likely trying to promote. If this occurs, the value of Bitcoin would possibly fall on the charts.

On the time of writing, the provision was all the way down to 931,000. Ought to this stay the case as time goes on, the cryptocurrency’s worth will rebound and it’d re-test $60,000 within the brief time period.

Supply: Santiment

Additionally, it appeared that Bitcoin could also be heading in direction of an ideal situation for a notable hike. For instance – AMBCrypto reported how the Crypto Concern and Greed Index dropped to excessive concern, hinting at a shopping for alternative.

In addition to that, the German authorities had a hand in pushing the value down on the again of its huge sell-offs. Lastly, Bitcoin additionally registered its highest ETF inflows for the month on 12 July.

Learn Bitcoin’s (BTC) Value Prediction 2024-2025

Ought to these situations stay, and if they’re later accompanied by shopping for strain, BTC’s worth would possibly start a hike that takes it in direction of $63,000 or $65,000 in a matter of weeks.

Nonetheless, this prediction might be invalidated if one other spherical of whale sell-offs seem. If that’s the case, Bitcoin would possibly fall to $57,000 once more.