- BNB’s worth elevated by greater than 4% within the final seven days.

- Metrics and indicators hinted at a continued worth rise.

Binance Coin (BNB) Traders have been having a good time because the coin’s worth rallied over the past week. Nevertheless, the momentum has declined in the previous few hours.

Although this regarded bearish at first look, it is likely to be a sign of yet one more bull rally.

BNB’s silent transfer

After a cushty rally of 4% final week, the coin slowed down. Based on CoinMarketCapBNB’s worth solely moved up marginally within the final 24 hours.

On the time of writing, the coin was buying and selling at $602.68 with a market capitalization of over $88.9 billion. The decline in momentum resulted in a drop in BNB’s 1-week worth volatility.

Aside from this, social metrics have been additionally affected.

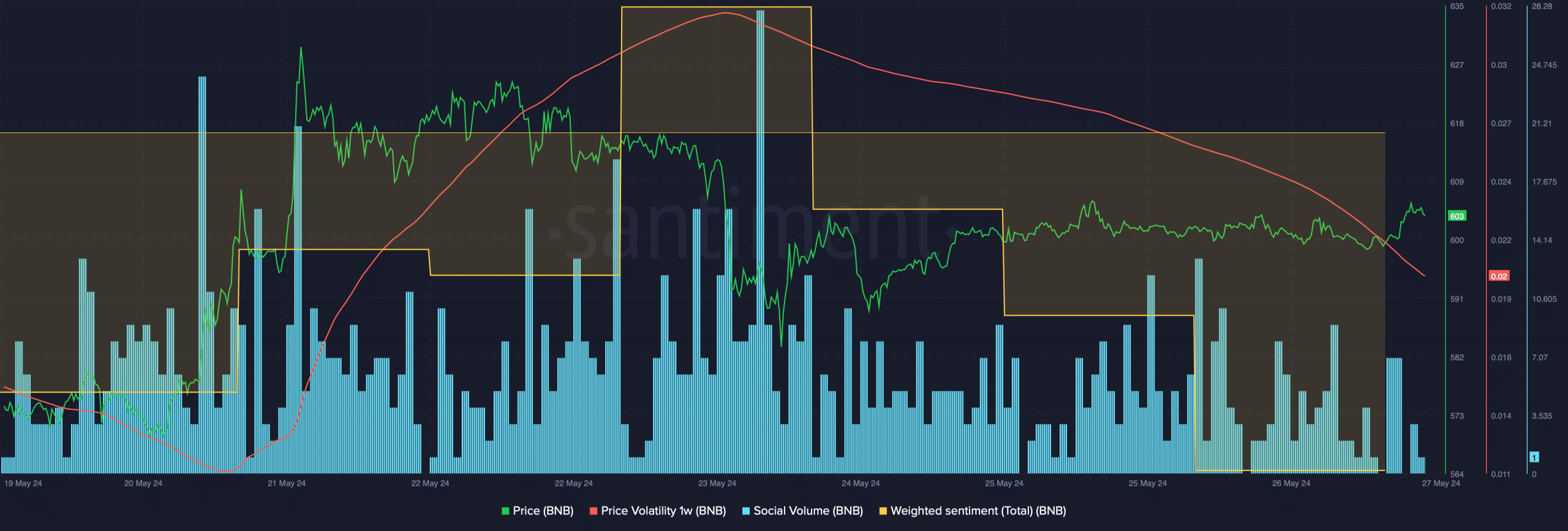

AMBCrypto’s take a look at Santiment’s information revealed that its Social Quantity declined sharply final week. Its Weighted Sentiment additionally dropped sharply on the twenty sixth of Might.

This clearly indicated that bearish sentiment across the coin was dominant out there.

Supply: Santiment

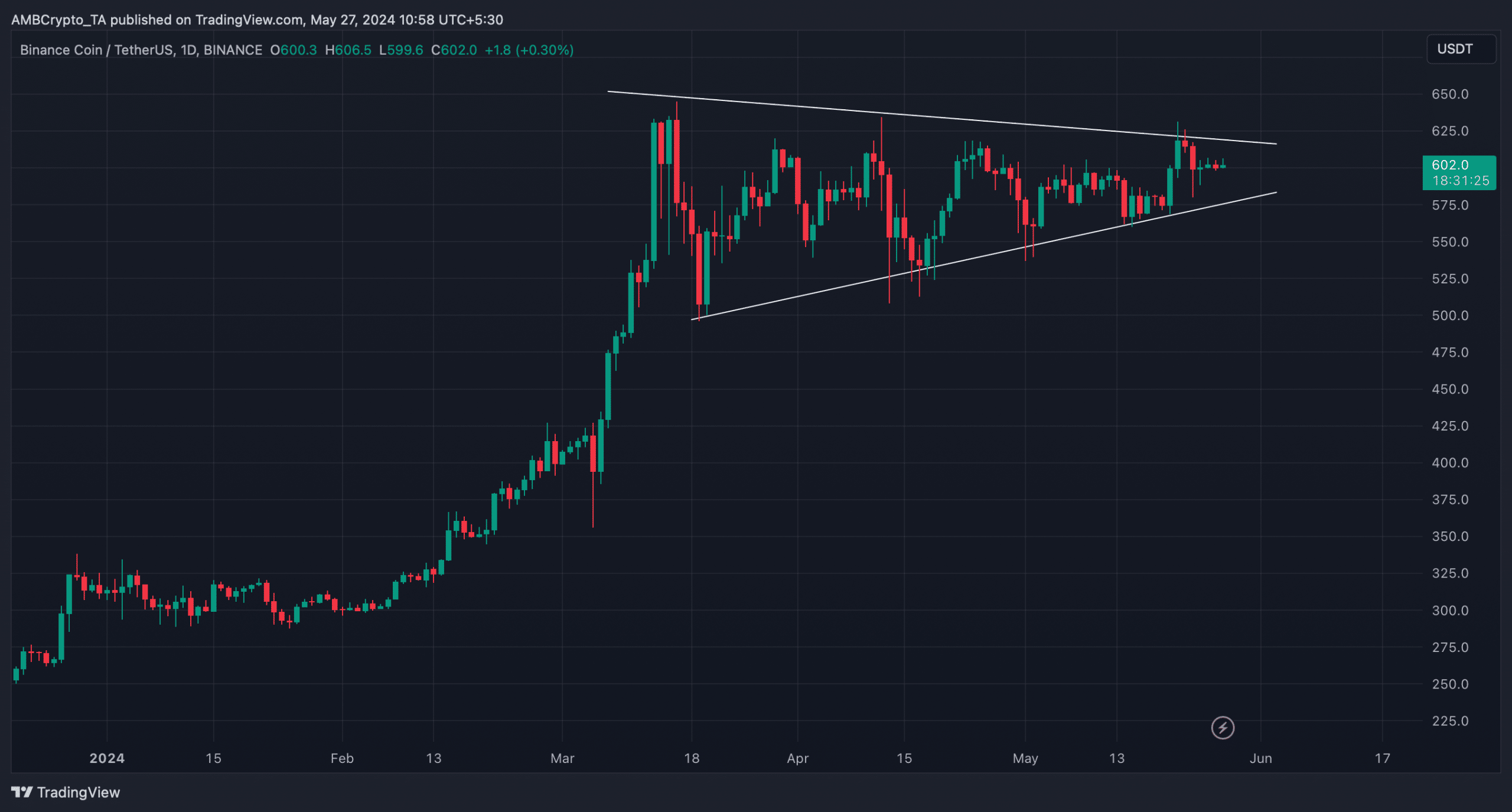

However BNB had a trick up its sleeve that would flip the state of affairs round. A bullish pennant sample appeared on the coin’s worth chart in mid-March. Since then, BNB has been consolidating contained in the sample.

At press time, the altcoin was on its option to check the higher restrict of the sample. So, a breakout above that would kick off yet one more bull rally.

In reality, if the bull rally occurs, then the coin may quickly check its all-time excessive of $686, which it touched again in 2021.

Supply: TradingView

Will BNB handle to interrupt out?

AMBCrypto then analyzed BNB’s on-chain information to see whether or not it hinted at a profitable breakout of the bullish pennant sample.

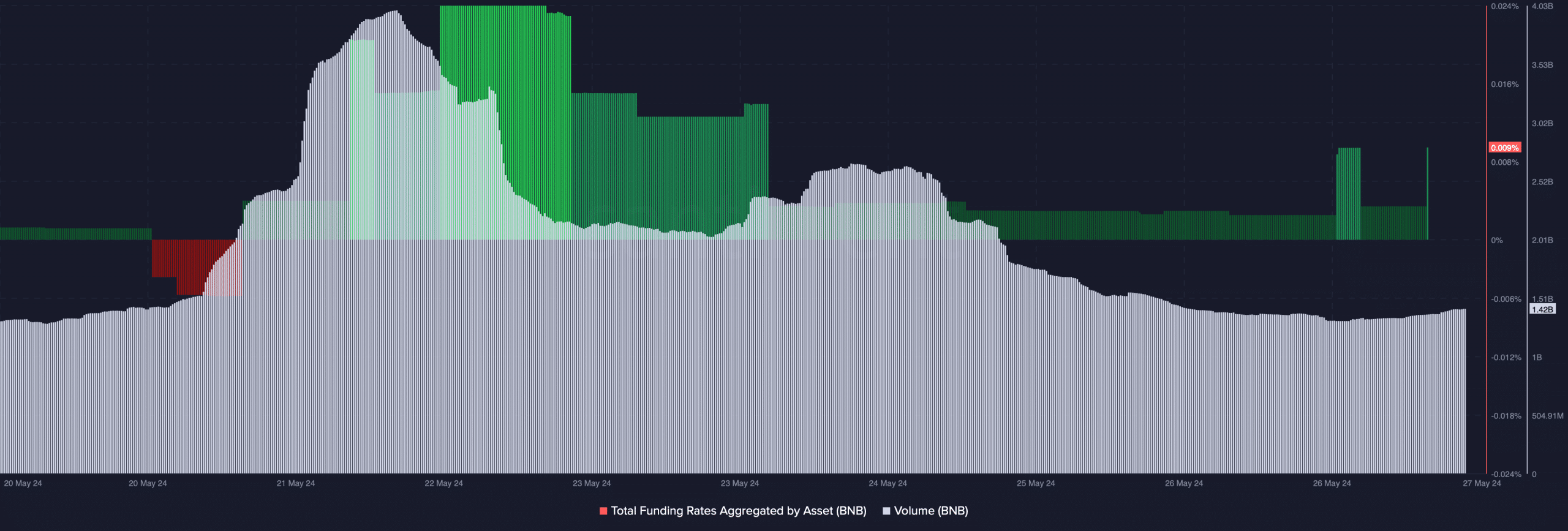

As per our evaluation, BNB’s buying and selling quantity declined whereas its worth volatility dropped. This hinted at a development reversal quickly.

Its Funding Price has additionally remained low, additional rising the possibilities of an increase in volatility within the coming days.

Supply: Santiment

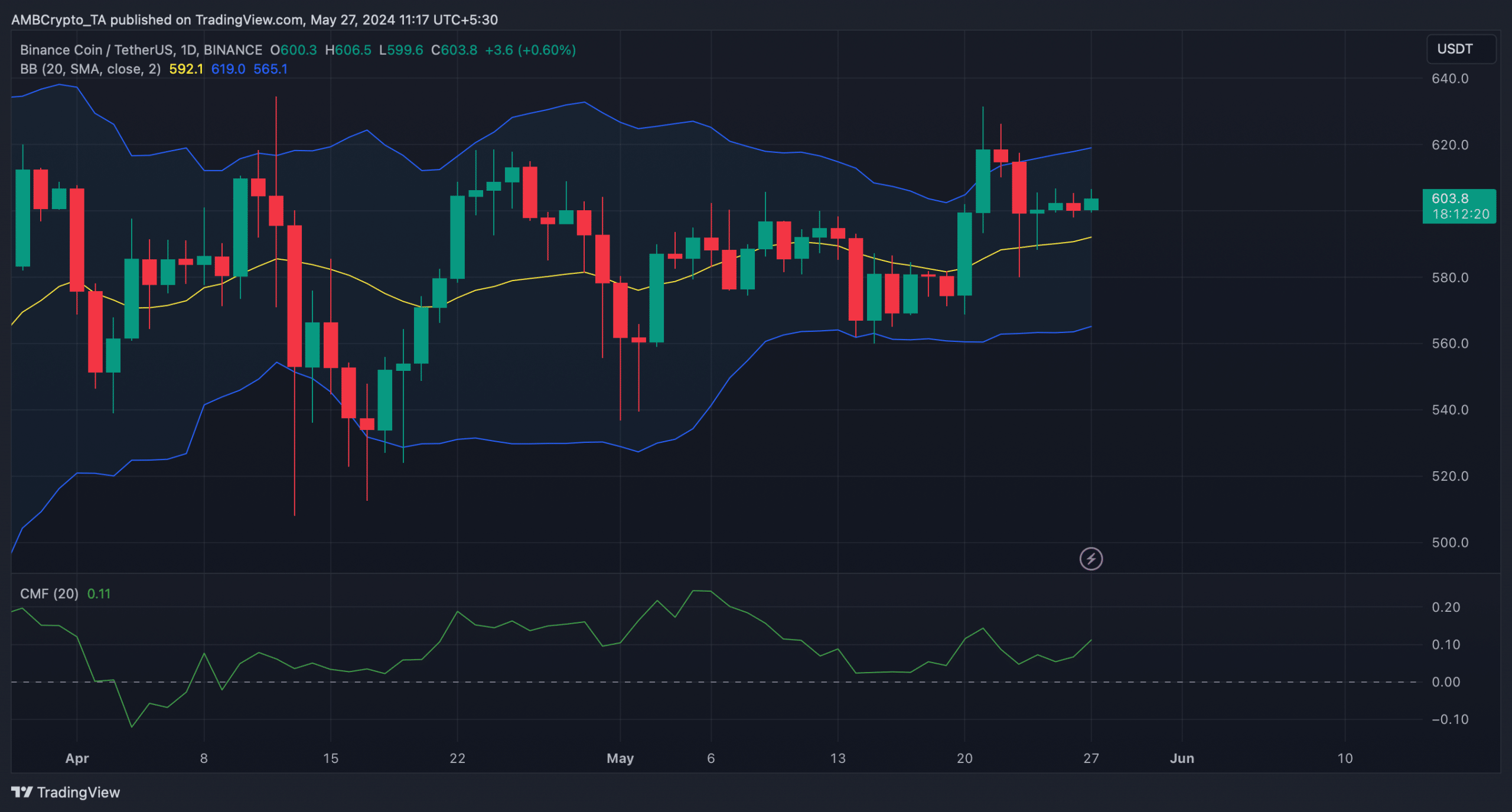

The coin’s worth was sitting on its 20-day Easy Shifting Common (SMA), hinting at a rebound.

On prime of that, the Chaikin Cash Circulation (CMF) additionally registered a pointy uptick, which urged that bulls may step in quickly and, in flip, permit BNB to interrupt above the bull sample.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the BNB Revenue Calculator

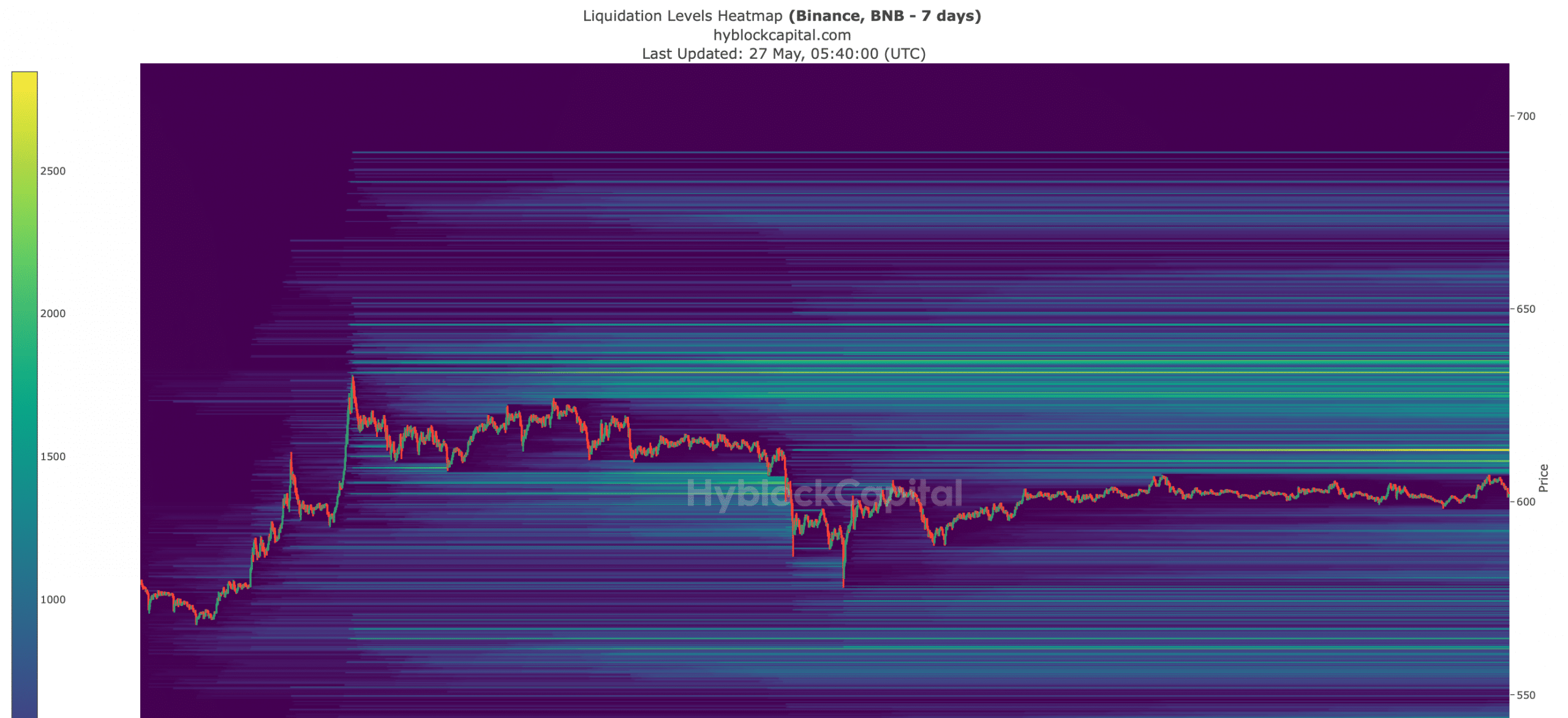

Nevertheless, with a view to maintain a bull rally, BNB should go above a robust resistance degree close to $613. This appeared to be the case, as liquidation would rise sharply at that mark, which may trigger a worth correction.

A profitable breakout above that might permit BNB to focus on new highs.

Supply: Hyblock Capital