- Cardano hinted at a bullish construction starting to type however the downtrend was not but reversed.

- Patrons needn’t FOMO but however can look ahead to a pivot stage to be flipped to help.

Cardano (ADA) costs bounced by 35% from Monday, the eighth of July to Saturday, the thirteenth of July. This swift value surge may be attributed to a rise in shopping for from giant holders.

The long-term pattern of the token was nonetheless bearish nevertheless it was possible that the close by psychological resistance stage at $0.5 could be pivotal over the approaching days.

This could be the cue that the bearish pattern has reversed

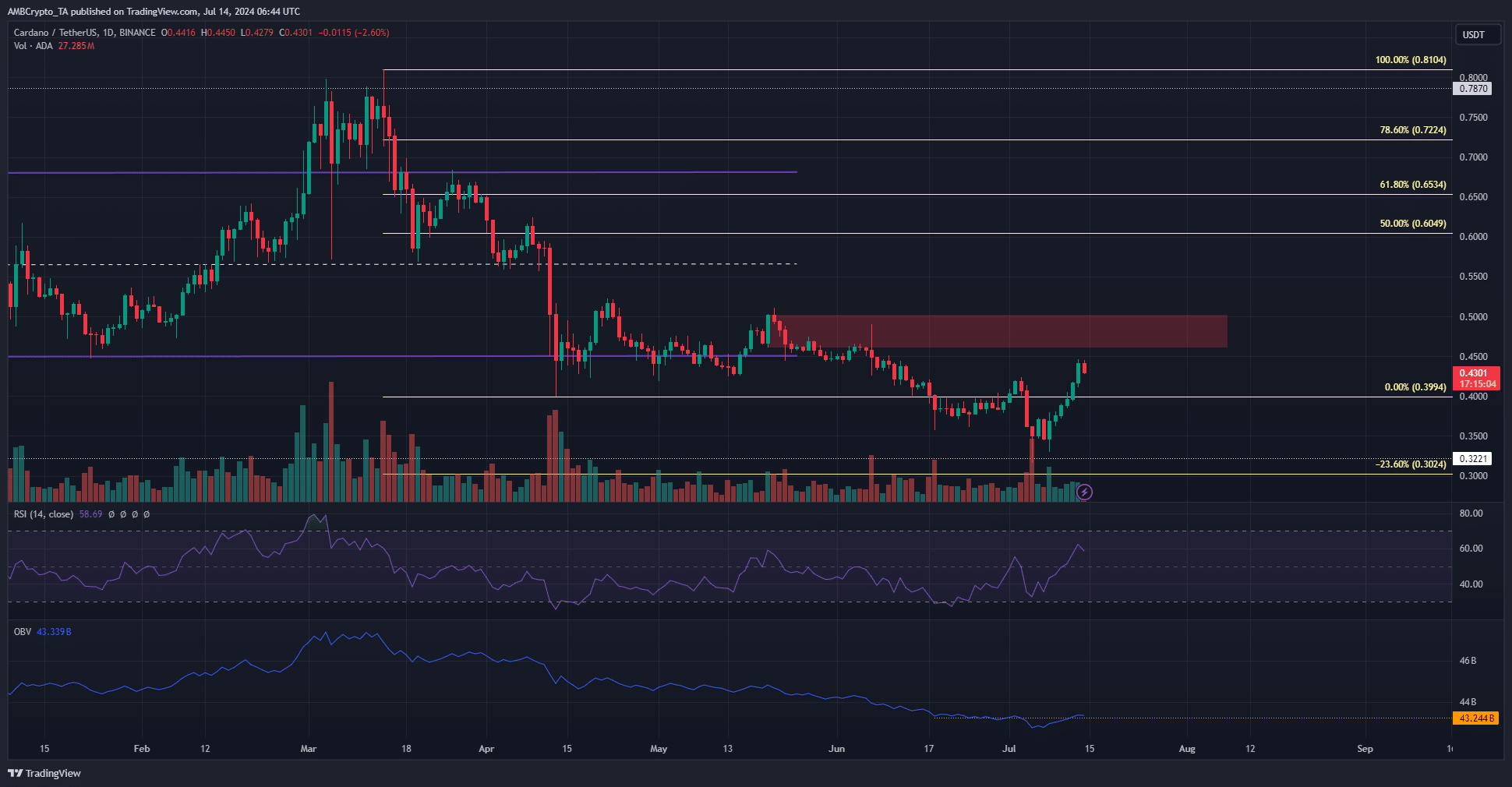

Supply: ADA/USDT on TradingView

The 1-day value chart has climbed above a latest decrease excessive at $0.4235, which is encouraging within the short-term. It’s a sign of a market construction shift, nevertheless it doesn’t assure an uptrend will comply with.

The previous vary low and the help zone at $0.44-$0.475 have been a stiff resistance zone. Moreover, there was a bearish order block (crimson) on the $0.46-$0.5 area. A day by day session shut above $0.5 would sign an uptrend can comply with. Till then, patrons should stay cautious.

The day by day RSI shot previous the impartial 50 mark, one other sign that momentum is shifting bullishly. The OBV climbed previous the lows from two weeks in the past, a sign that purchasing stress underpinned the latest beneficial properties.

Within the close to time period, a retest of the $0.42-$0.43 space may supply a shopping for alternative concentrating on $0.46-$0.5.

Whale accumulation had an uptick previously month

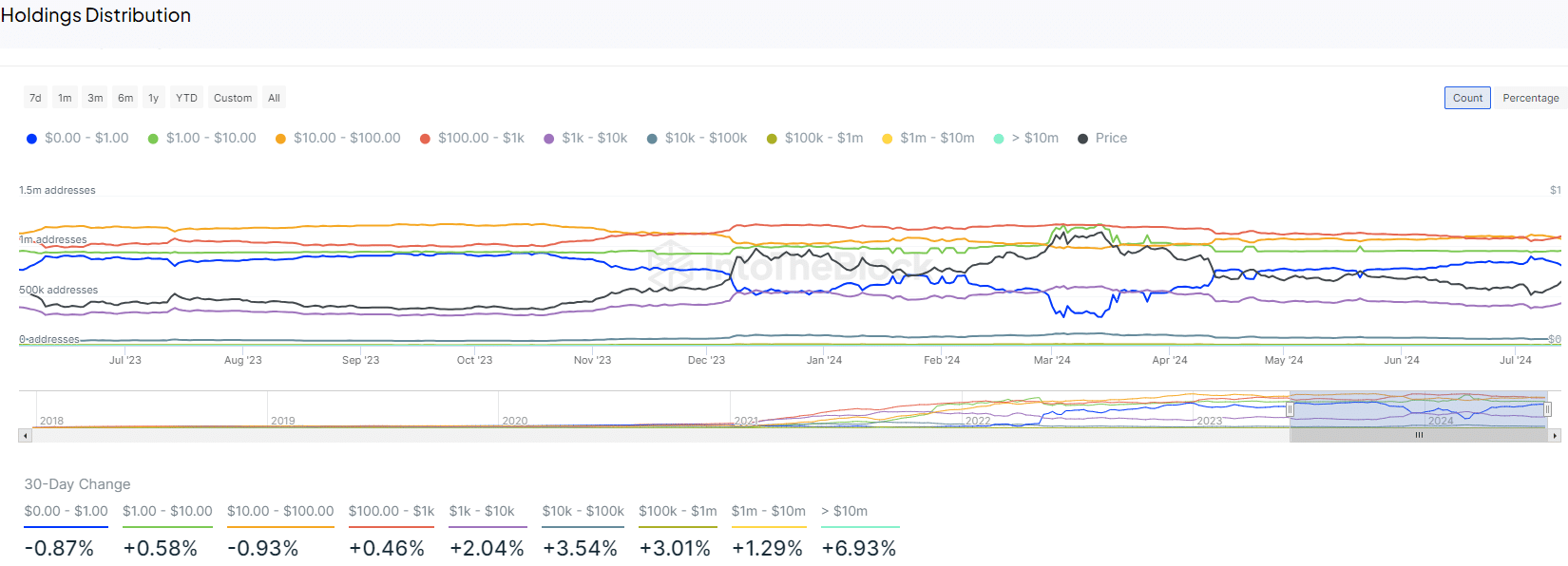

Supply: IntoTheBlock

The 30-day change of ADA holding distribution confirmed that addresses with tokens price greater than $10 million noticed a 6.93% rise over the previous month.

This strengthened the concept that whales have been accumulating through the regular value bleed that the token noticed in latest weeks.

Learn Cardano’s (ADA) Worth Prediction 2024-25

General, it appeared possible that Cardano would possibly provoke a transfer upward to $0.5.

A breakout previous that stage could be an indication of a long-term uptrend which may lengthen to the $0.57 and $0.68 ranges that have been vital earlier this yr.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.