7h41 ▪

7

min of studying ▪ by

Every bull run previously has gone via completely different phases stimulated by a capital rotation. Generally, bitcoin is commonly the chief of the bull run and the favourite within the early phases. Following Ethereum’s weaker efficiency in comparison with bitcoin, we are going to have a look at the components favorable to a capital rotation in direction of Ethereum.

The Precept of Asset Rotation

In conventional finance, there are a number of varieties of asset rotations. This will contain a sectoral rotation (know-how, industrial, monetary, well being…) or a rotation of asset sorts (bonds, shares, commodities, foreign exchange…). Capitals transfer based on the context and the financial system. The rotation can come from profit-taking after a big efficiency to maneuver into one other sector or a much less valued sort of asset whereas following the financial context. That is typically the case between cyclical and defensive sectors, for instance.

Let’s additionally take an instance over a really long-term horizon, that’s to say over a number of a long time, we will see this cyclical rotation between commodities and the S&P500 index within the graph under:

Any such graph highlights that within the coming years, performances in commodities must be extra advantageous than within the S&P500.

The Completely different Phases in Crypto

After we have a look at the cryptocurrency market, there are a number of phases by way of rotation, whether or not it’s between bitcoin, Ethereum, giant caps, and altcoins. And usually, this comes from a progressive rotation.

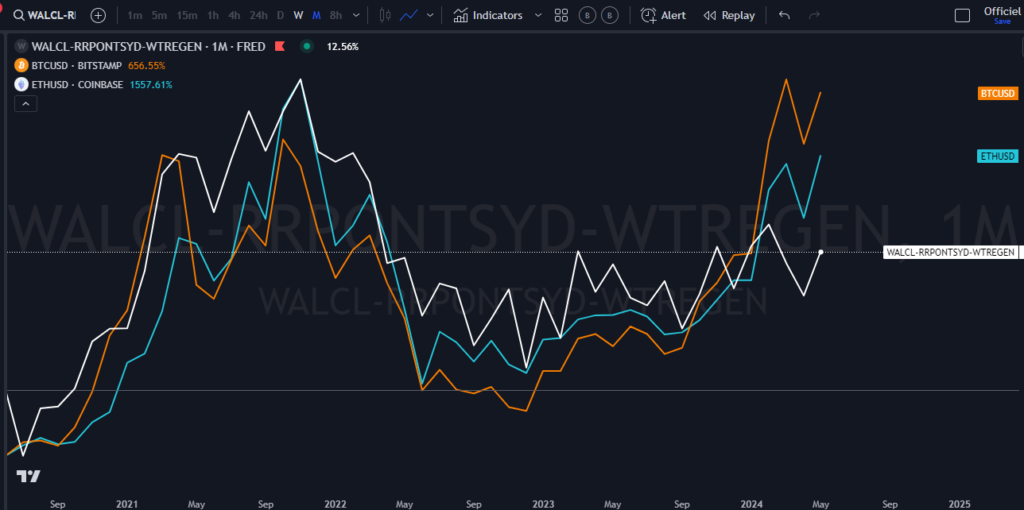

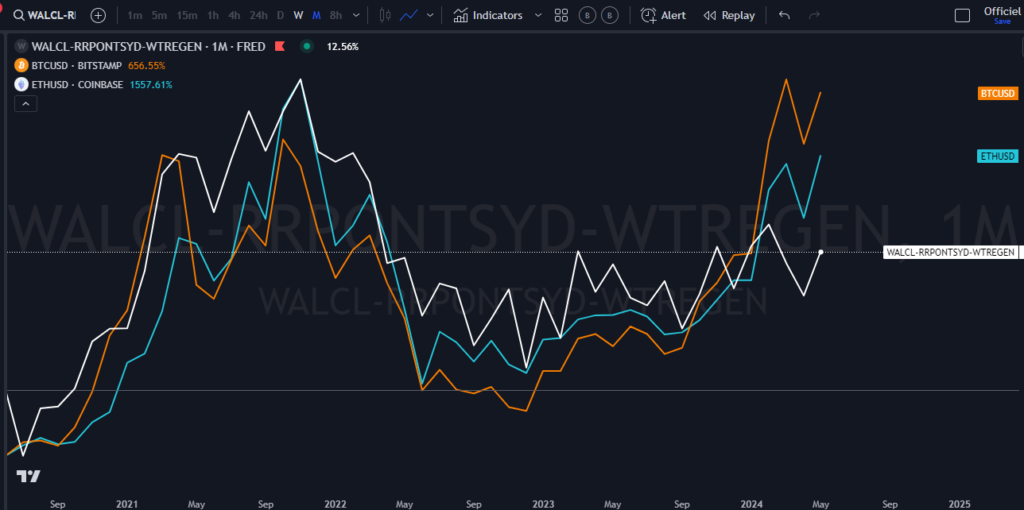

Part 1: Bitcoin is the chief, the shop of worth within the crypto market. It’s the oldest and most democratized within the cryptocurrency sphere. It’s on bitcoin that the primary capital inflows arrive originally of a bull market. Since 2024, bitcoin has been accessible in spot ETF type, which is a bonus to stimulate demand. And in parallel, when the demand is stimulated, it will increase the capital inflows. Throughout part 1, bitcoin tends to outperform Ethereum. And it’s only when Ethereum begins to strategy bitcoin’s efficiency that part 2 is close to. We will probably see this rotation with the instance under which highlights the ETC/BTC ratio:

Part 2: Ethereum, which is the quantity 2 cryptocurrency within the crypto sphere, outperforms bitcoin. This may be seen within the graph under with the 2021 bull run.

Part 3: It’s the flip of huge capitalizations (Doge, LTC, XRP…) to outperform bitcoin.

Part 4: The altcoin season begins when there’s a giant capital rotation. That’s to say, the cash invested in bitcoin originally of the bull run strikes to different cryptocurrencies, small and mid-capitalizations, and even memes. Throughout the altcoin season, we see a discount in bitcoin dominance. Here’s a graph that highlights this:

To raised illustrate this generally phrases, right here is the chronology under:

The Financial Surroundings and Completely different Phases in Cryptocurrency Markets

The evolution of cryptocurrency is sort of cyclical, identical to the financial system. That’s to say, we discover cycles of development and cycles of decline. Like every riskier asset class, it evolves based on a good and accommodating context. A beneficial context will be outlined in a number of methods. For instance, when development rebounds, now we have an acceleration of development, which is a good setting for cryptocurrencies. Shopper sentiment is constructive and this encourages capital inflows. Conversely, after we face an financial slowdown, it’s typically represented by a bear market in cryptocurrencies. Every cycle typically averages one and a half to 2 years, identical to financial cycles. Subsequently, if we add up a bull market and a bear market, it represents 4 years, identical to the halving course of:

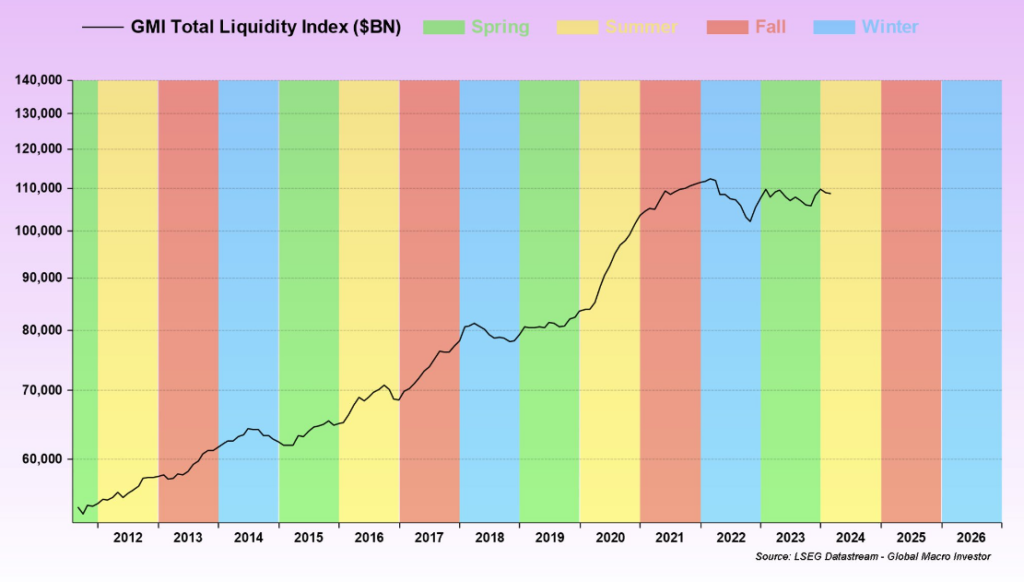

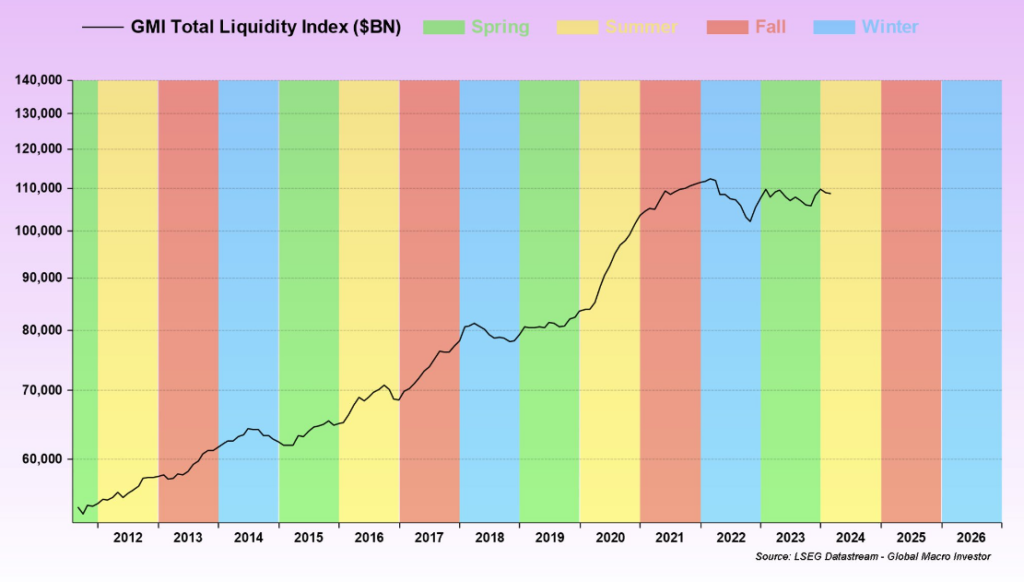

One other constructive component for efficiency can be liquidity. When liquidity is considerable, cryptocurrencies thrive. For instance, injections of liquidity throughout COVID led to extra capital circulating within the markets. Monetary circumstances had been extremely relaxed. Subsequently, more cash in circulation to purchase the identical good implies a worth improve.

Relating to liquidity within the present scenario, we will see the graph under highlighting the evolution of liquidity and bitcoin:

Remaining in the identical context, that’s, liquidity, we will additionally see favorable seasons (summer season and fall being the very best):

The Delay of Ethereum Defined by A number of Elements

As talked about earlier, Ethereum is commonly delayed in comparison with bitcoin through the first months of a bull run. That is primarily as a result of capital first flows into bitcoin, the shop of worth. As for Ethereum, it’s now not the one one well-positioned as it’s carefully adopted by Solana. This additionally implies competitors. That stated, like bitcoin, Ethereum ought to profit from extra incoming flows because the approval of ETFs is official. Such merchandise suggest extra potential to draw new traders, whether or not for tax causes (introduction of the product into tax-advantaged accounts) or just because an ETF is an simply accessible product (no must open a number of brokerage accounts) and is cheap. For this reason approval can be a superb catalyst for catching up with bitcoin. Subsequently, there are a number of arguments that align for Ethereum’s outperformance, similar to a good context, new accessible merchandise, and the part timeline (as indicated above).

Bitcoin or Ethereum, Which to Select?

Bitcoin and Ethereum have completely different strengths that may assist diversify a crypto portfolio. Considered one of bitcoin’s peculiarities is that it has a restricted provide of 21 million, and its manufacturing is halved each 4 years. This may be seen as a secure haven, particularly in international locations affected by hyperinflation. Ethereum additionally has sure peculiarities, similar to the truth that it may be used to host different cryptos and decentralized purposes.

The extra adoption and democratization proceed with the identical dynamic, the extra we are going to face new merchandise as approvals can be more and more simpler. For instance, we may have an ETF that brings collectively bitcoin and Ethereum to simplify the selection. This opens up many prospects by way of capital.

Conclusion

We will conclude that the capital rotation system is cyclical and that Ethereum has a number of causes to take the lead and outperform bitcoin for the remainder of the cycle. One of many main catalysts for this is able to be, like bitcoin, ETF approval. This can enhance liquidity within the coming months.

Maximize your Cointribune expertise with our ‘Learn to Earn’ program! Earn factors for every article you learn and acquire entry to unique rewards. Join now and begin accruing advantages.

Click on right here to hitch ‘Learn to Earn’ and switch your ardour for crypto into rewards!

After touring for 7 days from a Canadian financial institution however not 5 days after signing a portfolio similar to analysts, I stop my capabilities after I’ve absolutely thought-about the deserves of monetary marches. However it’s exactly this that democratizes the data of monetary marches which have acquired the eye of the viewers in numerous features, noting the macro evaluation, the technical evaluation, the inner evaluation…

DISCLAIMER

The views, ideas, and opinions expressed on this article belong solely to the creator, and shouldn’t be taken as funding recommendation. Do your personal analysis earlier than taking any funding choices.