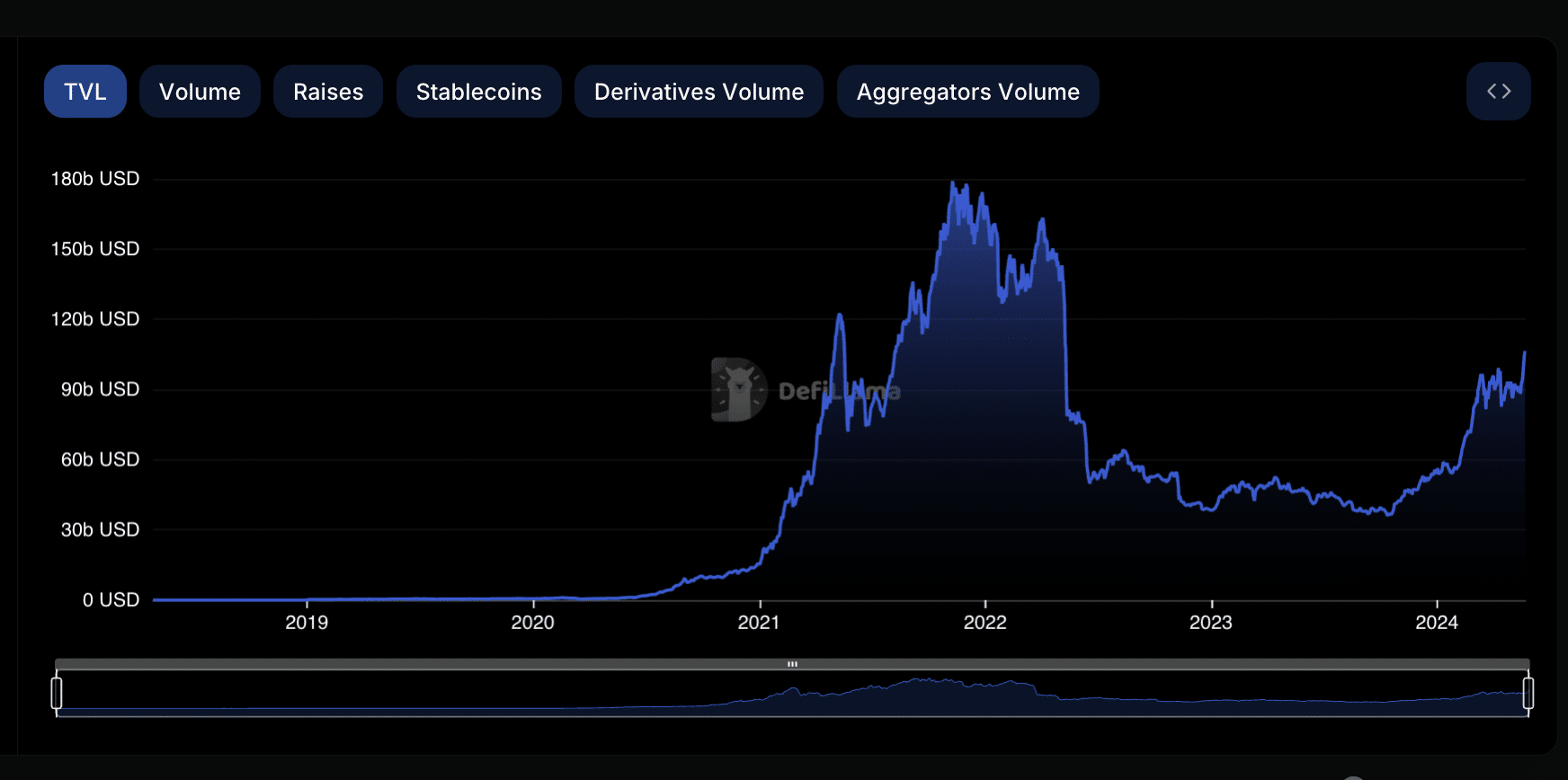

- DeFi TVL has now sat at its highest since Could 2022.

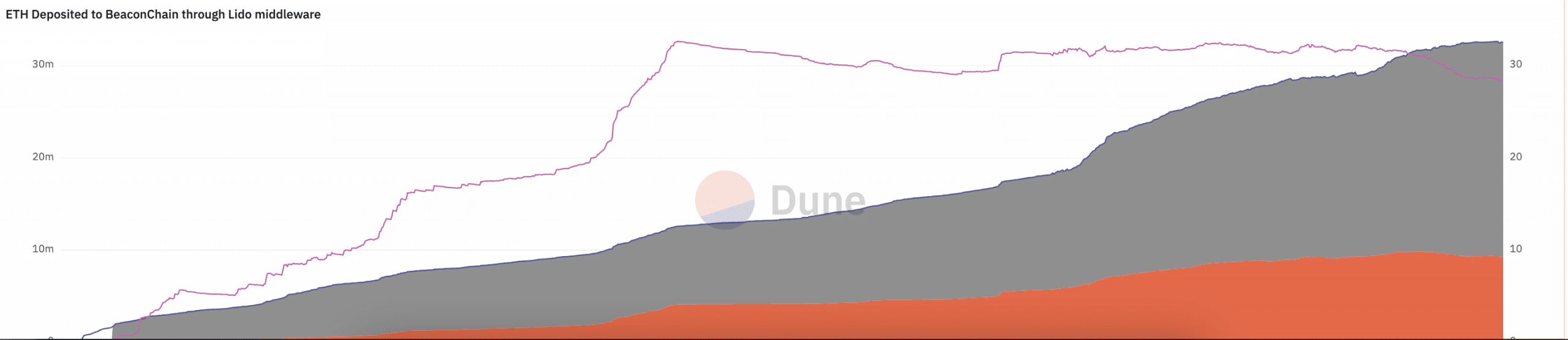

- Lido’s share of the ETH staking market is declining.

The full worth locked (TVL) throughout decentralized finance (DeFi) protocols has risen to a two-year excessive amid the overall market rally, in line with DefiLlama’s information.

At press time, DeFi TVL was $106.45 billion. Assessed on a year-to-date (YTD), this has elevated by 96% because the starting of the 12 months.

Supply: DefiLlama

Lido sees a decline in market share

The worth of property locked throughout the swimming pools on Lido Finance (LDO), the main Ethereum (ETH) staking supplier and the biggest DeFi protocol by TVL, has surged steadily since twelfth Could.

Previous to this era, the protocol’s TVL had plummeted to a two-month low of $27.43 billion. Nevertheless, because the values of cryptocurrency property started to rise in the course of Could, Lido’s TVL adopted the pattern and has since grown by 30%.

Curiously, Lido’s share of the ETH staking ecosystem has declined. On the time of writing, 28.6% of all ETH deposited to the BeaconChain was made by means of Lido, per information from Dune Analytics. The final time the liquid staking protocol’s share was this low was on seventeenth April, 2022.

Supply: Dune Analytics

This decline comes amid a broader pattern of reducing ETH staked throughout a number of platforms over the previous few days.

Data retrieved from The Block’s information dashboard confirmed that after peaking at a YTD excessive of 27% on thirteenth Could, the proportion of ETH’s whole provide that has been staked has since fallen by 4%.

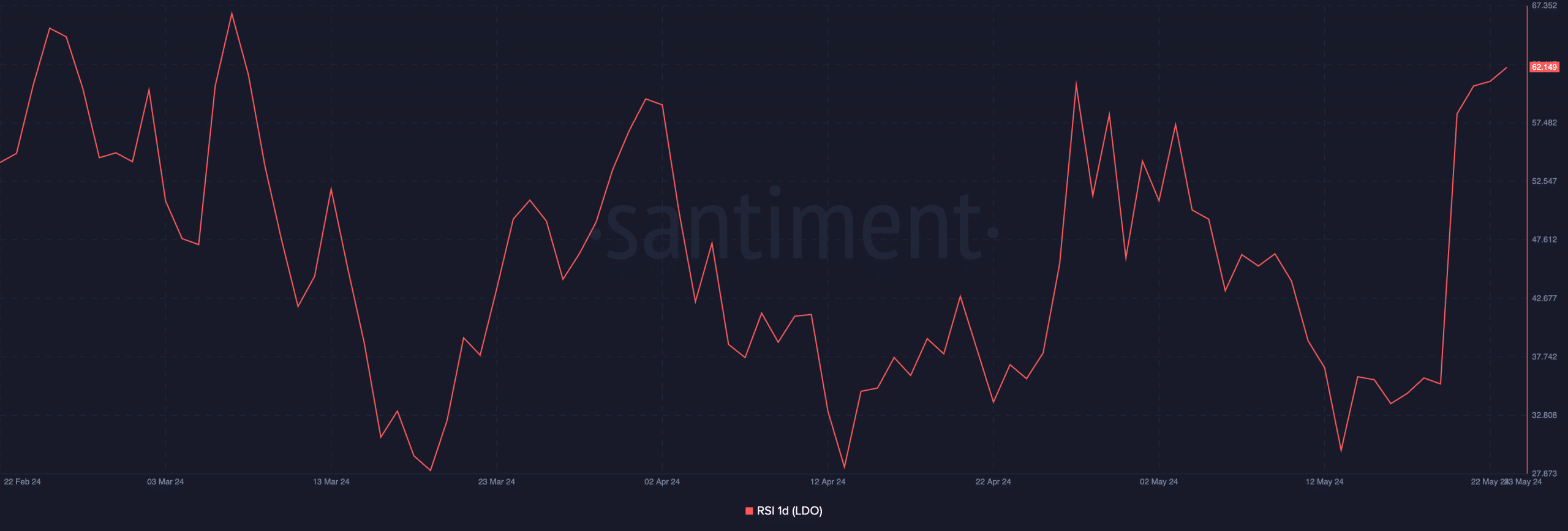

LDO sees surge in demand

Concerning the protocol’s governance token, LDO, it exchanged palms at $2.13 at press time. Based on CoinMarketCap, the altcoin’s worth has risen by over 30% within the final week.

The spike within the token’s worth is attributable to the rise in demand throughout that interval. Santiment’s information confirmed a rally in its Relative Energy Index (RSI) since 19 Could. At 62.149 at press time, LDO’s RSI confirmed that purchasing momentum was extra vital than promoting strain.

Supply: Santiment

Reasonable or not, this is LDO’s market cap in BTC’s phrases

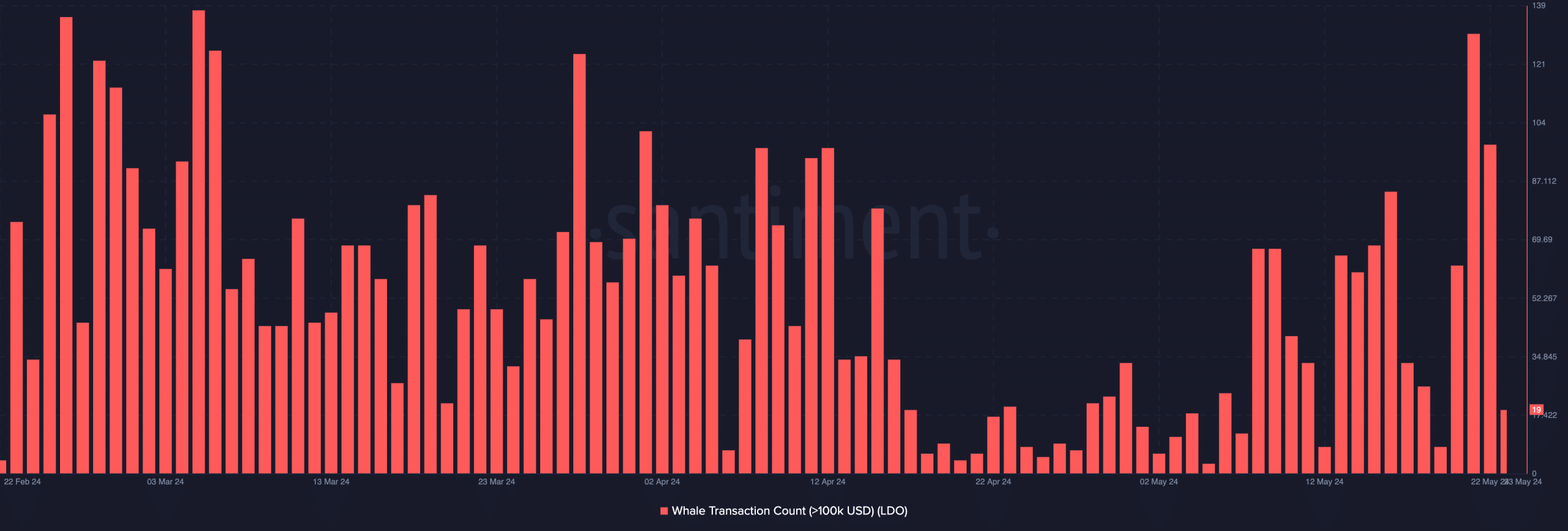

Additional, LDO whale exercise has surged up to now few days. The truth is, on twenty first Could, the each day rely of LDO whale transactions that exceeded $100,000 climbed to its highest since sixth March.

On that day, 131 LDO transactions valued above $100,000 had been accomplished.

Supply: Santiment