- The most important ETH ETF, Grayscale, had a single-day outflow of $210 million.

- ETH additionally turned bearish, and most metrics hinted at a continued value drop.

Alternate Traded Funds (ETFs) have gained a lot traction for the reason that starting of this yr with the launch of Bitcoin (BTC) ETFs. Issues acquired even higher over the past week as Ethereum (ETH) ETFs began buying and selling.

Due to this fact, let’s take a look at how these two ETFs are faring in opposition to one another.

BTC ETFs vs. ETH ETFs

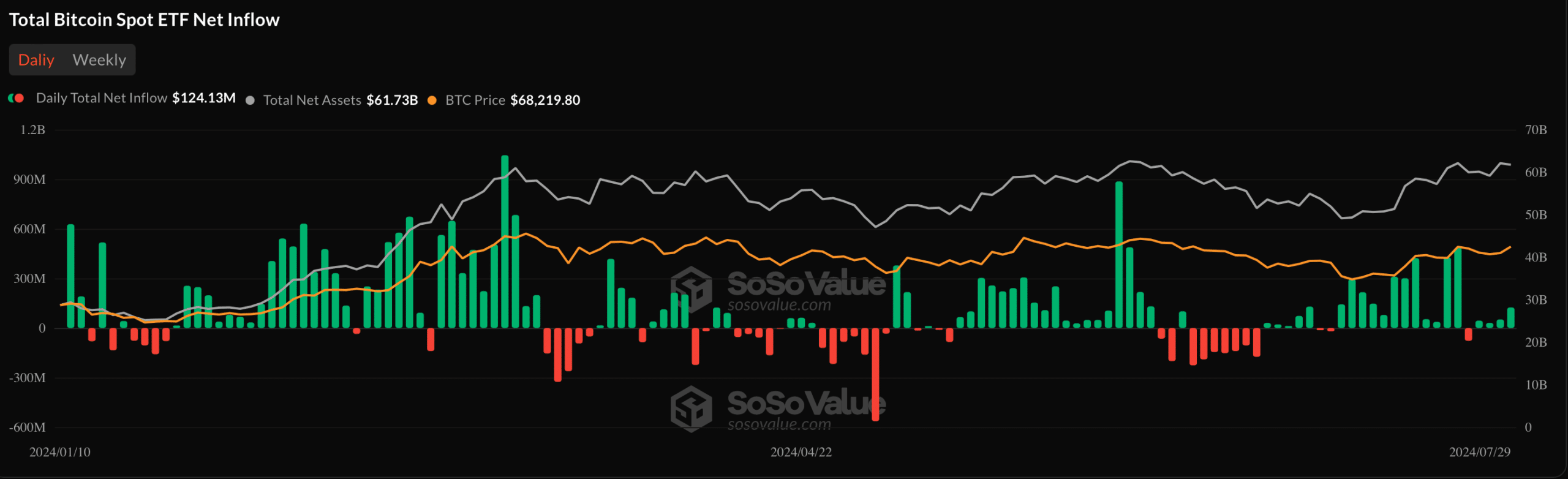

Since its launch, Bitcoin ETFs have witnessed main inflows and comparatively a lot decrease outflows. The Bitcoin spot ETF had a complete internet influx of $124 million on twenty ninth July and continued to have internet influx for 4 consecutive days.

BlackRock ETF IBIT had an influx of $206 million. Nonetheless, the magnitude of inflows has declined over the previous couple of weeks.

Supply: SoSoValue

Whereas BTC’s common netflow remained constructive, Ethereum ETFs had a special destiny.

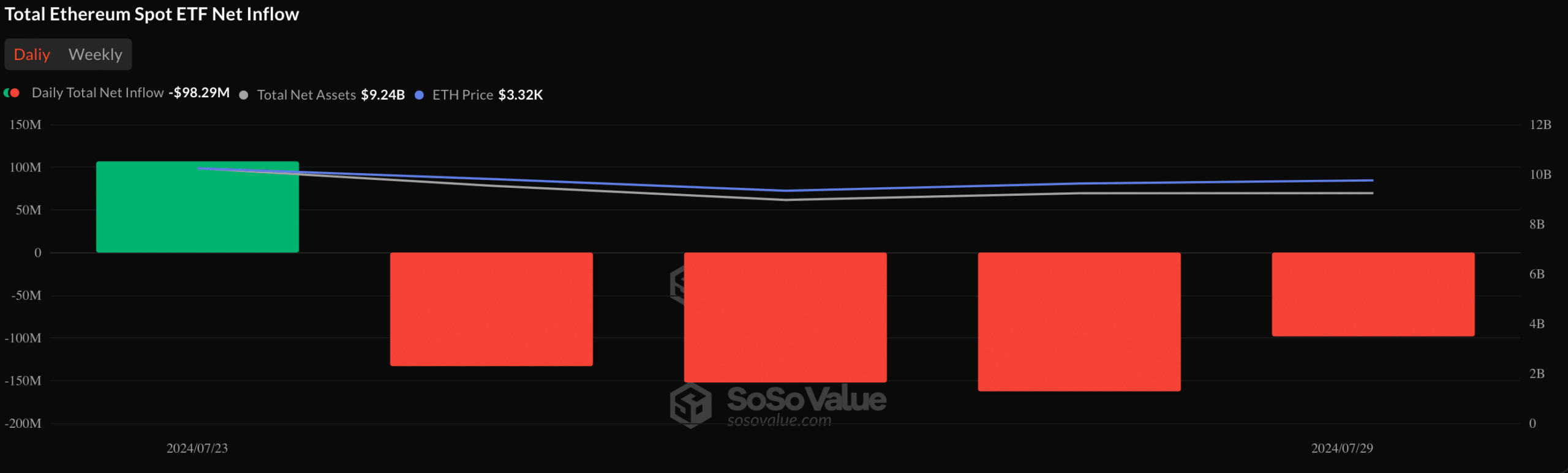

Ethereum spot ETF had a complete internet outflow of $98.2856 million on twenty ninth July and continued to have internet outflows for 4 consecutive days.

Grayscale ETF ETHE, the most important ETH ETF, had a single-day outflow of $210 million. Nonetheless, the second largest ETH ETF registered an influx of $4.8967 million.

Supply: SoSoValue

Impression of ETFs on Ethereum

The outflow over the previous 4 consecutive days had a adverse affect on the king of cryptos’ chart. In keeping with CoinMarketCapETH’s value dropped by greater than 3% final week.

The bearish value development continued within the final 24 hours because the token’s worth plummeted by over 1%. On the time of writing, ETH was buying and selling at $3,322.91 with a market capitalization of over $399 billion.

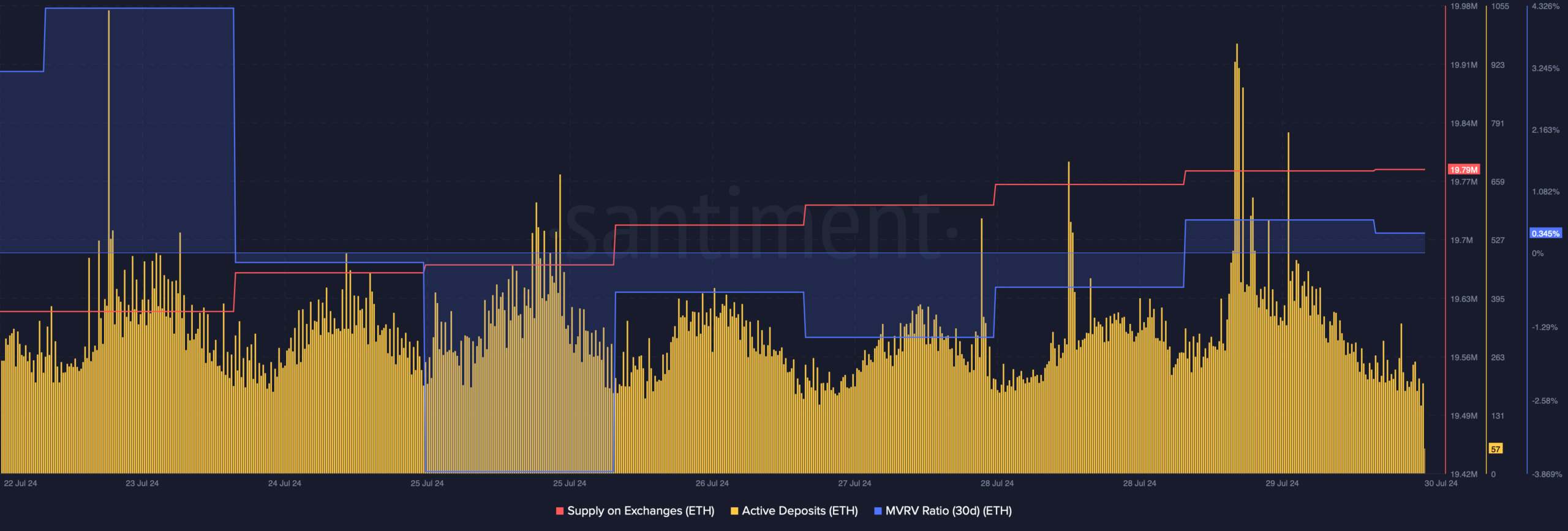

AMBCrypto then checked Santiment’s knowledge to higher perceive what is going on on with the token. We discovered that promoting stress on it elevated as its energetic deposits went up.

The truth that buyers had been promoting ETH was additional confirmed by the rise in its provide on exchanges over the past seven days.

Nonetheless, after a significant dip, Ethereum’s MVRV ratio improved on the twenty ninth of July, which will be inferred as a bullish sign.

Supply: Santiment

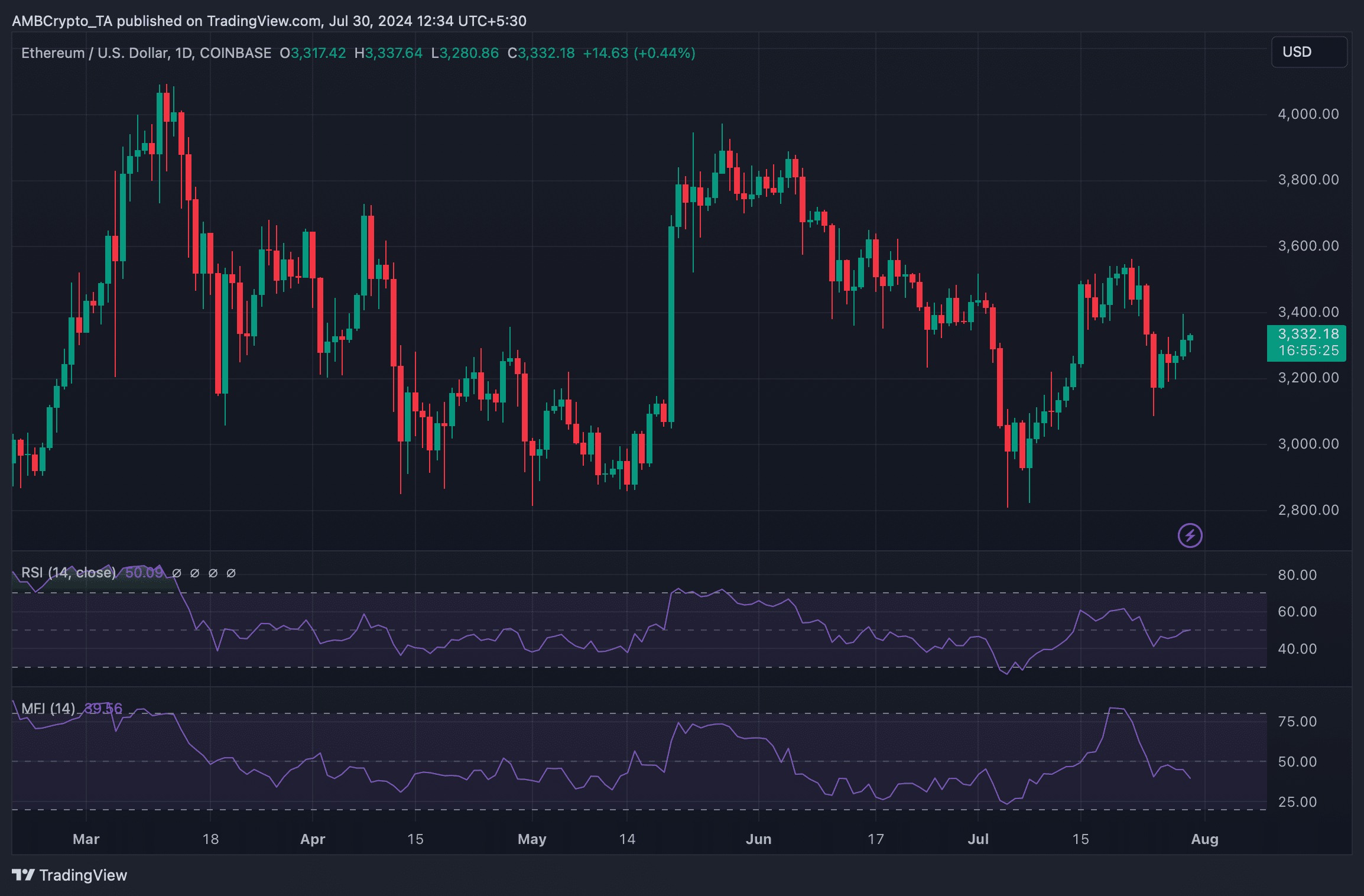

The technical indicator Relative Power Index (RSI) registered a pointy uptick. This indicated that the probabilities of ETH’s value turning bullish once more had been excessive.

Nonetheless, the Cash Stream Index (MFI) remained bearish because it went southwards.

Supply: TradingView

Learn Bitcoin’s (BTC) Worth Prediction 2024-25

Whereas ETH’s value dropped, Bitcoin additionally adopted the same development. As per CoinMarketCap, BTC was down by practically 4% within the final 24 hours.

At press time, it was buying and selling at $66,829 with a market cap of $1.31 trillion.