By Brigid Riley

TOKYO (Reuters) – The greenback was agency on Monday because the euro hovered close to a greater than one-month low amid continued issues concerning the political outlook in Europe.

The market additionally braced for a slew of top-tier financial knowledge from China as buyers sought readability on how a lot the world’s second-largest financial system is struggling to achieve momentum.

The euro was practically flat at $1.0703, selecting up considerably after falling to its lowest since Might 1 at $1.06678 on Friday. The forex additionally logged its greatest weekly decline since April at 0.88% final week.

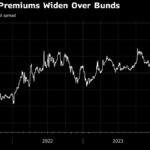

Traders have been considering the chance of a finances disaster on the coronary heart of the euro space, as far proper and leftist events achieve momentum forward of France’s shock parliamentary election, pressuring President Emmanuel Macron’s centrist administration.

Even after the French monetary markets endured a brutal sell-off late final week, European Central Financial institution policymakers haven’t any plan to debate emergency purchases of French bonds, 5 sources advised Reuters.

Though the political turmoil is a euro-bearish story, “because the euro accounts for round 57% of the weighting, the autumn of the euro has not directly benefited the greenback,” mentioned Matt Simpson, senior market analyst at Metropolis Index.

The , which measures the dollar towards a basket of peer currencies, was little modified at 105.49, after touching its highest since Might 2 at 105.80 on Friday.

Minneapolis Federal Reserve President Neel Kashkari on Sunday mentioned it is a “cheap prediction” that the US central financial institution will minimize rates of interest as soon as this 12 months, ready till December to do it.

The Fed printed up to date projections final week that confirmed the median forecast from all 19 US central bankers was for a single rate of interest minimize this 12 months.

The week is gentle on main US financial knowledge to assist make clear the Fed’s outlook, though US retail gross sales on Tuesday and flash PMIs on Friday could give hints about consumption and financial power.

“Knowledge would probably must miss estimates by a large margin to rekindle bets of extra Fed cuts, with the FOMC assembly nonetheless freshly within the minds of buyers,” mentioned Metropolis Index’s Simpson.

Sterling was final buying and selling at $1.2687, up 0.04% on the day. Britain’s inflation pressures nonetheless seem too sizzling for the Financial institution of England to chop charges at its June 20 assembly. A Reuters ballot printed final week confirmed 63 of 65 economists thought a primary minimize wouldn’t come till Aug. 1.

The yen struggled to achieve its footing after the BOJ shocked markets when the central financial institution introduced saved bond shopping for unchanged at its assembly on Friday, as an alternative pushing particulars of its tapering plan to its July coverage assembly.

Governor Kazuo Ueda mentioned, nevertheless, he wouldn’t rule out elevating rates of interest in July as weak spot within the yen pushes up import prices.

The yen was final up 0.05% at 157.41 per greenback, after slipping to 158.26 after Friday’s resolution, its lowest since April 29.

The yen’s decline to a 34-year low of 160.245 per greenback on the finish of April triggered a number of rounds of official Japanese intervention totaling 9.79 trillion yen.

Japan’s core equipment orders fell 2.9% in April from the earlier month, Cupboard Workplace knowledge confirmed on Monday.

Elsewhere, the offshore held round 7.2699 per greenback forward of the dump of home knowledge within the Asian morning.

In cryptocurrencies, bitcoin final rose 1.62% to $66,794.00.