- Binance remained probably the most dominant trade regardless of a 22% decline.

- BNB adopted the overall market pattern with over 1% decline within the final 24 hours.

Latest knowledge signifies Binance’s spot buying and selling quantity decreased within the second quarter. Regardless of this decline, it maintained its dominant place available in the market.

Nonetheless, it is vital to notice that its dominance has diminished in comparison with earlier years.

Blended metrics for Binance dominance

Latest knowledge from Coingecko analyzing the efficiency of centralized exchanges revealed that Binance continued to steer as the highest trade. Nonetheless, its dominance has skilled some erosion.

The information signifies that Binance’s spot buying and selling quantity reached an annual low of $424.7 billion. This decline marks a 22.7% month-on-month lower from $549.8 billion recorded in Might 2024.

Regardless of these fluctuations, it held a 46.6% share of the overall spot buying and selling quantity amongst centralized exchanges for Q2 of 2024.

Additionally, though it noticed a rise in market dominance from Q1 to Q2 of 2024, ending the primary quarter with a 48.9% market share, it seems to be dropping floor once more.

In absolute phrases, the trade generated $1.67 trillion in buying and selling quantity throughout Q2 of 2024. This was a 19.8% decline from $2.08 trillion in Q1 of 2024.

Traditionally, Binance’s market share was over 60% round 2022, but it surely has declined considerably over the following years.

Why Binance’s dominance has waned over time

Binance’s journey within the trade has been marked by vital challenges, significantly regarding regulatory points throughout varied world jurisdictions. These regulatory hurdles have notably impacted its operations and aggressive standing.

In some areas, equivalent to Canada, Binance has needed to halt operations totally as a result of regulatory constraints. This retreat from key markets displays the broader compliance challenges the trade faces.

Moreover, its current authorized troubles in the USA have additional sophisticated its place.

The conclusion of a regulatory investigation resulted in a considerable monetary penalty for the trade and, much more consequentially, the imprisonment of its former CEO, Changpeng Zhao (CZ).

These developments have affected Binance’s operational stability and status amongst customers and buyers.

These setbacks have supplied a gap for different exchanges like Coinbase and Bybit to erode a few of the dominance the trade as soon as loved.

As these opponents proceed to develop and probably capitalize on their regulatory misfortunes, the dominance may wane additional.

The BNB falls

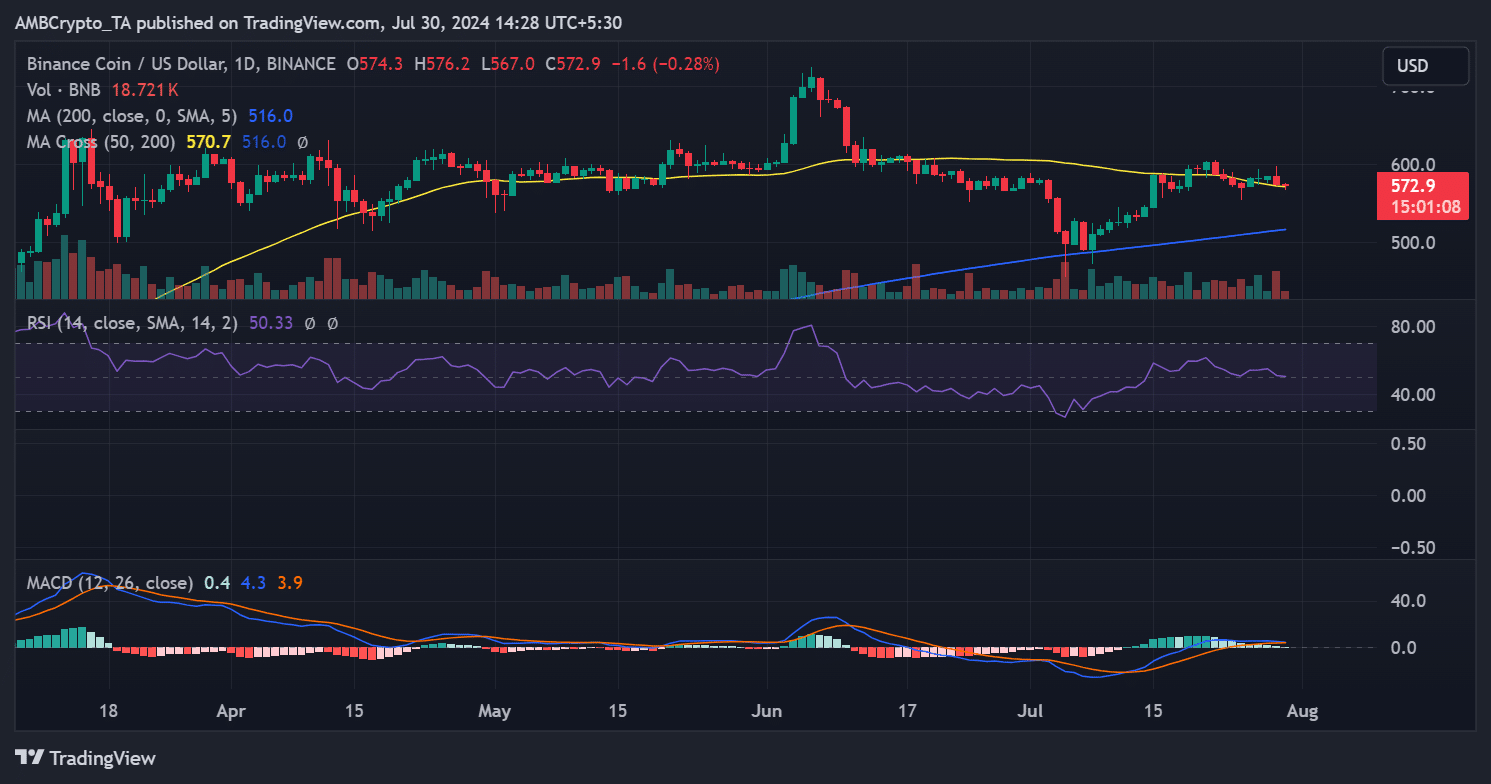

The each day value pattern evaluation of Binance Coin (BNB) reveals that it has been mirroring broader market actions.

On July twenty ninth, BNB skilled a decline of over 1.6%, falling from roughly $584 to round $574 by the tip of buying and selling. As of the newest knowledge, BNB is buying and selling at about $573, representing a slight decline of 0.3%.

Supply: TradingView

Learn Binance (BNB) Value Prediction 2024-25

Regardless of these current decreases, BNB remained above the impartial line on its Relative Energy Index (RSI), suggesting it nonetheless holds bullish momentum throughout the prevailing market circumstances.