- XRP has been consolidating contained in the bull sample since final 12 months.

- The token would possibly retest the sample earlier than starting a bull rally.

The crypto market turned considerably sluggish within the final 24 hours as there was no main value motion, and XRP was not an exception.

Nevertheless, this simply is perhaps the calm earlier than a storm as a long-term bullish sample appeared on XRP’s weekly value chart, which may end in a large bull rally.

XRP’s bullish breakout

CoinMarketCap’s knowledge revealed that XRP’s value solely managed to maneuver marginally prior to now week. On the time of writing, XRP was buying and selling at $0.6024 with a market capitalization of over $33 billion, making it the seventh largest crypto.

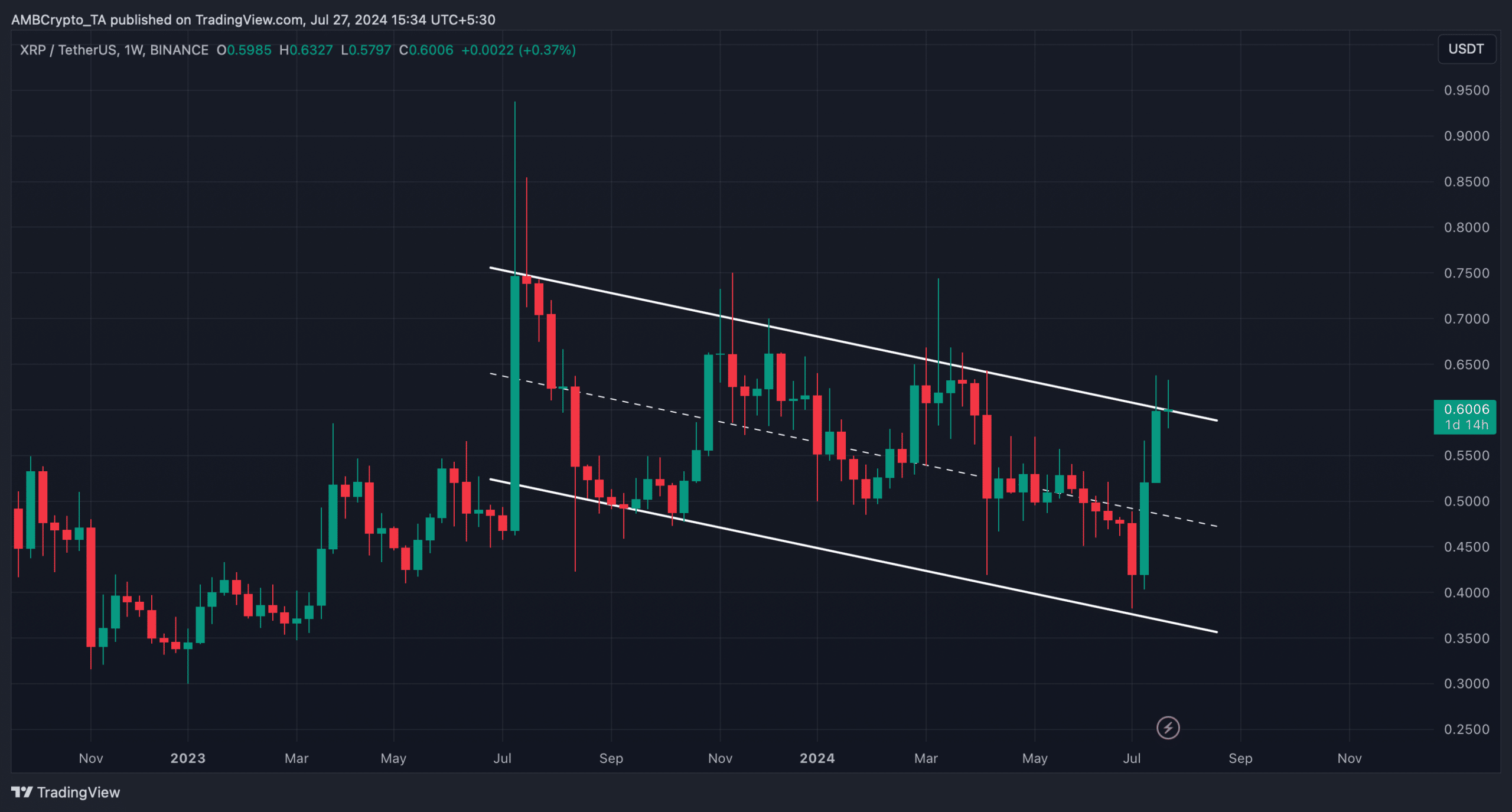

AMBCrypto’s evaluation of XRP’s weekly chart revealed a long-term descending channel sample.

Supply: TradingView

The sample emerged on the token’s weekly chart final 12 months in July, and since then its value has been consolidating contained in the sample.

The higher information was that on the time of writing, XRP had damaged above that sample. If the sample exams, then traders would possibly witness the token would possibly retest its 2023 highs within the coming months.

Will XRP start a bull rally?

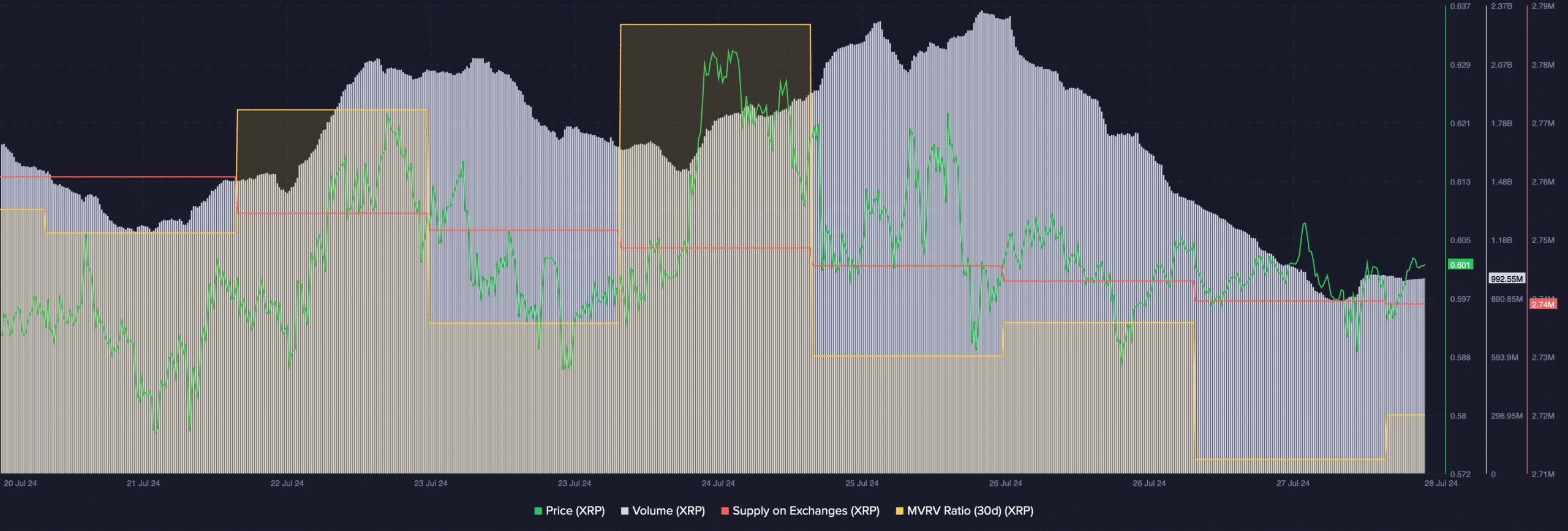

AMBCrypto then took a take a look at XRP’s on-chain knowledge to see whether or not they backed the potential for a contemporary bull rally. As per our evaluation of Santiment’s knowledge, XRP’s buying and selling quantity declined whereas its value dropped.

This recommended that traders have been reluctant to commerce XRP at a lower cost.

Moreover, its provide on exchanges continued to drop, suggesting that purchasing strain remained excessive. Nevertheless, the regarding metric was the MVRV ratio, which dropped, hinting that value will plummet.

Supply: Santiment

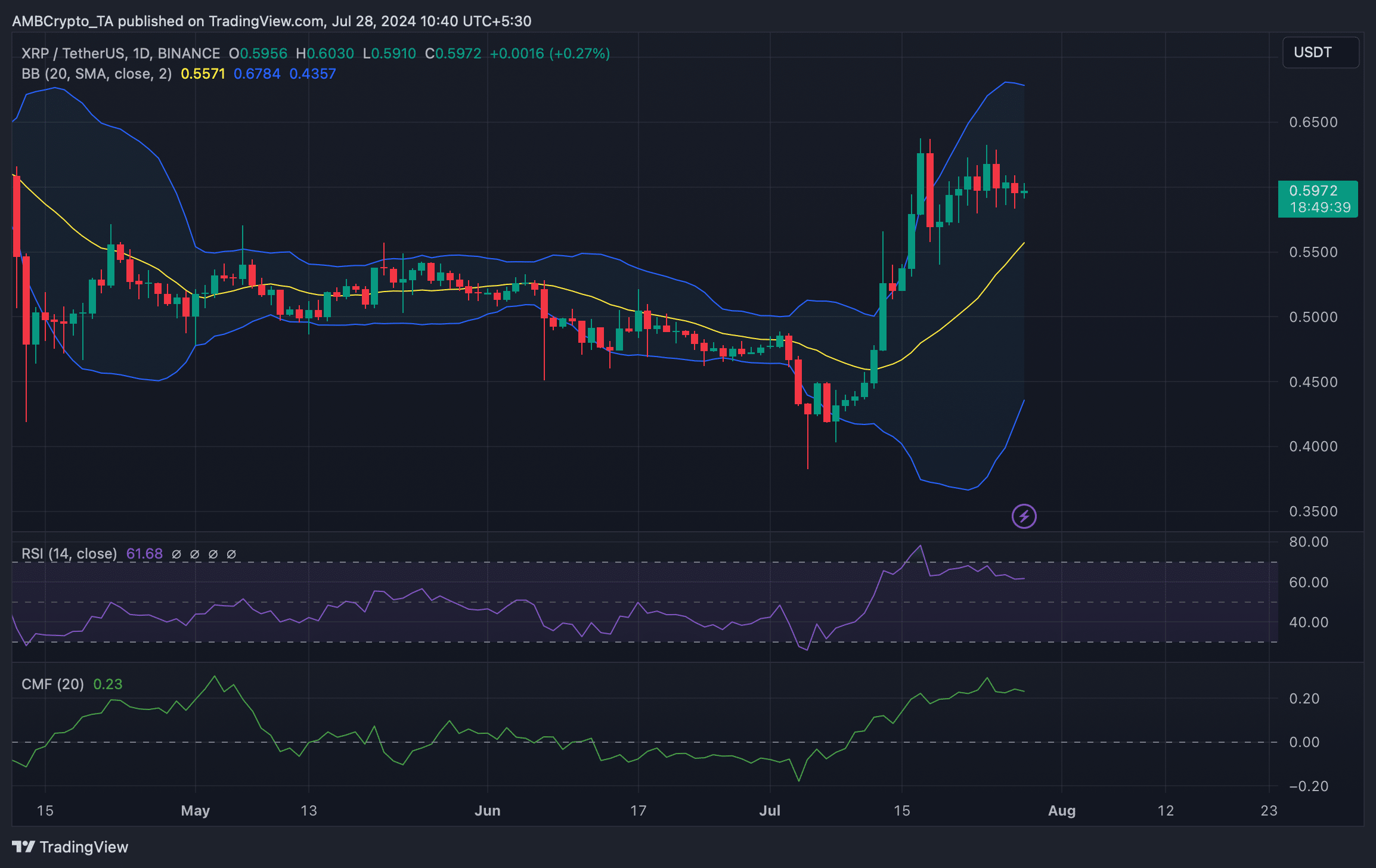

Moreover, on the time of writing, worry and greed index had a worth of 62%, which means that the market was in a “greed” section.

At any time when the metric hits this stage, it signifies that the probabilities of a value correction are excessive. Just like the aforementioned metrics, most market indicators additionally seemed bearish.

As an example, the Relative Energy Index (RSI) registered a downtick. An identical declining development was additionally famous on the Chaikin Cash Movement’s (CMF) graph.

Learn Ripple’s (XRP) Worth Prediction 2024-25

Furthermore, the token’s value had touched and retracted from the higher restrict of the Bollinger Bands.

Nevertheless, traders should not lose hope but, as these metrics and indicators would possibly simply be suggesting a retest on the bullish breakout. If that is true, then XRP’s would start a bull rally within the following days.

Supply: TradingView