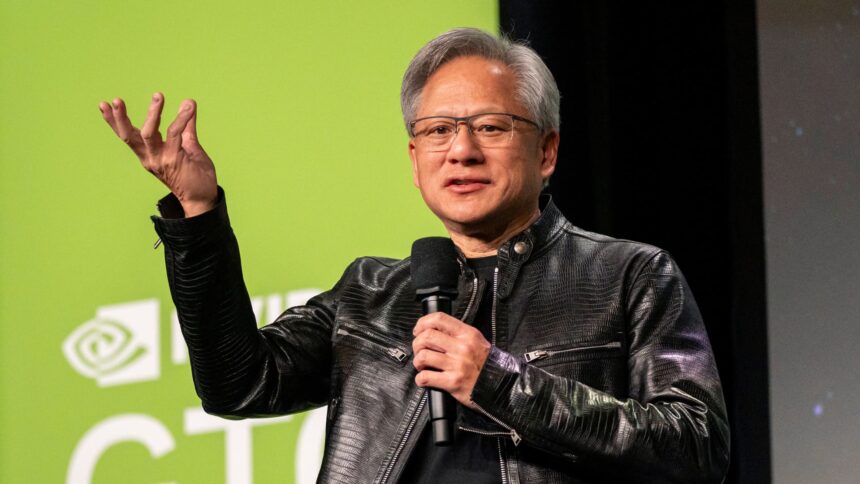

Jensen Huang, co-founder and chief government officer of Nvidia Corp., through the Nvidia GPU Expertise Convention (GTC) in San Jose, California, US, on Tuesday, March 19, 2024.

David Paul Morris | Bloomberg | Getty Pictures

Nvidia reported fiscal first-quarter earnings on Wednesday that beat expectations for gross sales and earnings, and offered a powerful forecast for the present quarter.

Nvidia’s outcomes have develop into a method for traders to gauge the power of the AI growth that has transfixed markets in current months. Its robust outcomes on Wednesday counsel that demand for the AI chips Nvidia makes stays robust.

The inventory rose over 3% in prolonged buying and selling. Nvidia stated it was splitting its inventory 10 to 1.

- Earnings Per Share: $6.12 adjusted vs. $5.59 adjusted, per LSEG consensus estimates.

- Income: $26.04 billion vs. $24.65 billion anticipated by LSEG

Nvidia stated it anticipated gross sales of $28 billion within the present quarter. Wall Road was anticipating earnings per share of $5.95 on gross sales of $26.61 billion, in line with LSEG.

Nvidia reported internet revenue for the quarter of $14.88 billion, or $5.98 per share, in contrast with $2.04 billion, or 82 cents, within the year-ago interval.

Prior to now 12 months, Nvidia gross sales have skyrocketed as corporations similar to Google, Microsoft, Meta, Amazon and OpenAI purchase billions of {dollars} of Nvidia’s GPUs, that are superior and dear chips required for creating and deploying synthetic intelligence purposes.

The corporate’s largest and most necessary enterprise is its information heart gross sales, which incorporates its AI chips in addition to lots of the extra elements wanted to run large AI servers.

Nvidia stated its information heart class rose 427% from the year-ago quarter to $22.6 billion in income. Nvidia CFO Colette Kress stated in a press release that it was as a consequence of shipments of the corporate’s “Hopper” graphics processors, which embrace the corporate’s H100 GPU.

“Massive cloud suppliers continued to drive robust development as they deploy and ramp NVIDIA AI infrastructure at scale, representing mid-40% of our Information Heart income,” Kress stated within the assertion.

At the same time as the corporate stories a tripling or extra of its enterprise, CEO Jensen Huang stated that the corporate’s next-generation AI GPU, known as Blackwell, would result in extra development.

“”We’re poised for our subsequent wave of development,” Huang stated in a press release.

Nvidia additionally highlighted robust gross sales of its networking elements, that are more and more necessary as corporations construct clusters of tens of hundreds of chips that should be linked. Nvidia stated that it had $3.2 billion in networking income, primarily its Infiniband merchandise, which was over 3 times greater than final 12 months’s gross sales.

Nvidia, earlier than it turned the highest provider to large corporations constructing AI, was recognized primarily as an organization making {hardware} for 3D gaming. The corporate’s gaming income was up 18% through the quarter to $2.65 billion, which Nvidia attributed to robust demand.

The corporate additionally sells chips for vehicles and chips for superior graphics workstations, which stay a lot smaller than its information heart enterprise. The corporate reported $427 million in skilled visualization gross sales, and $329 million in automotive gross sales.

Nvidia stated it purchased again $7.7 billion price of its shares and paid $98 million in dividends through the quarter. Nvidia additionally stated that it is growing its quarterly money dividend from 4 cents per share to 10 cents on a pre-split foundation. After the cut up, the dividend can be a penny a share.