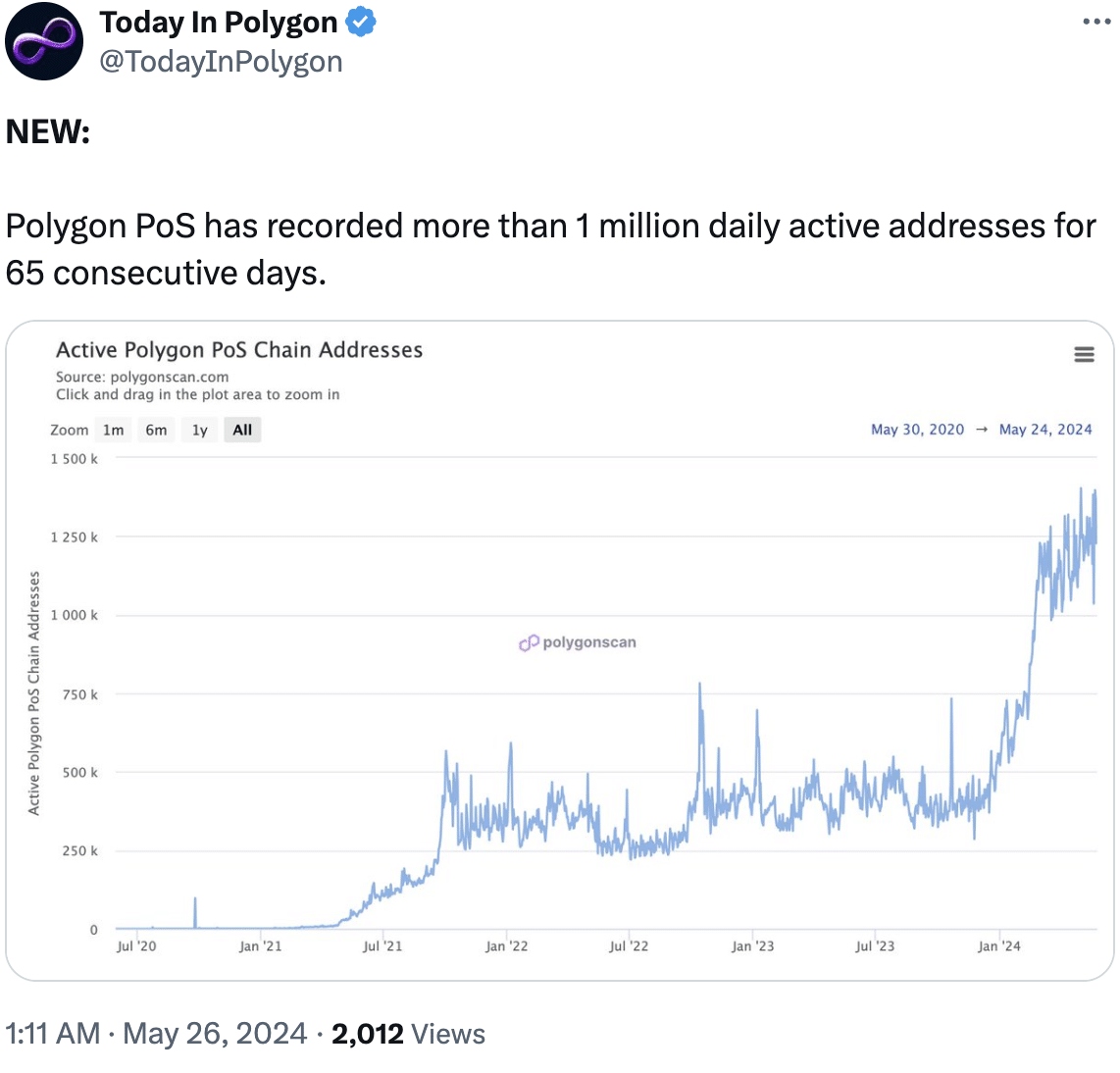

- Polygon community constantly surpassed 1 million each day energetic addresses for 65 days.

- TVL and DEX volumes declined.

Polygon (MATIC) continued to draw a considerable amount of customers over the previous few months. Not solely was the ecosystem in a position to appeal to customers, however it was additionally in a position to retain them.

Polygon exercise on the rise

The Polygon community maintained a file of greater than 1 million each day energetic addresses for 65 days straight, based on current knowledge.

Supply: X

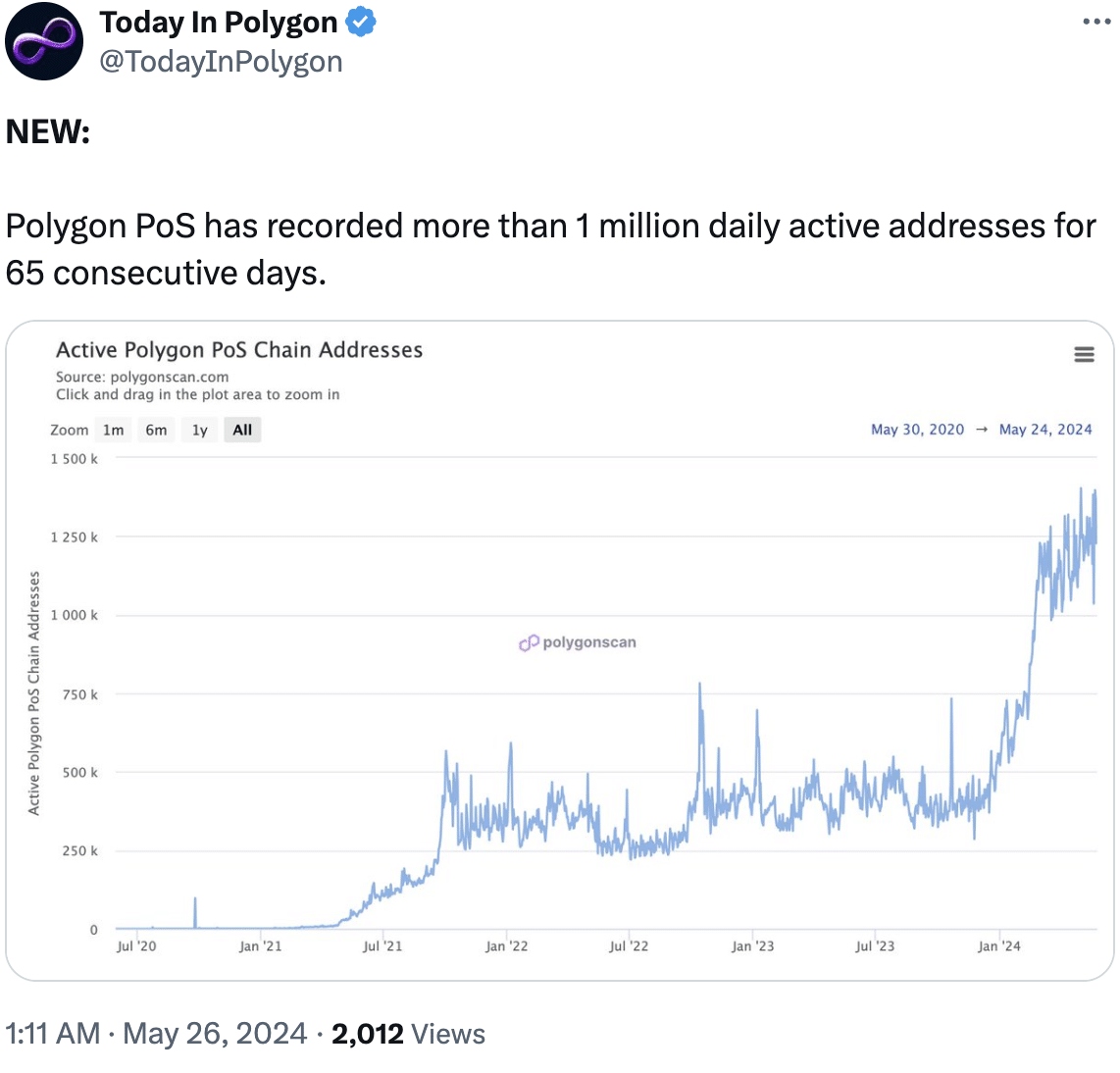

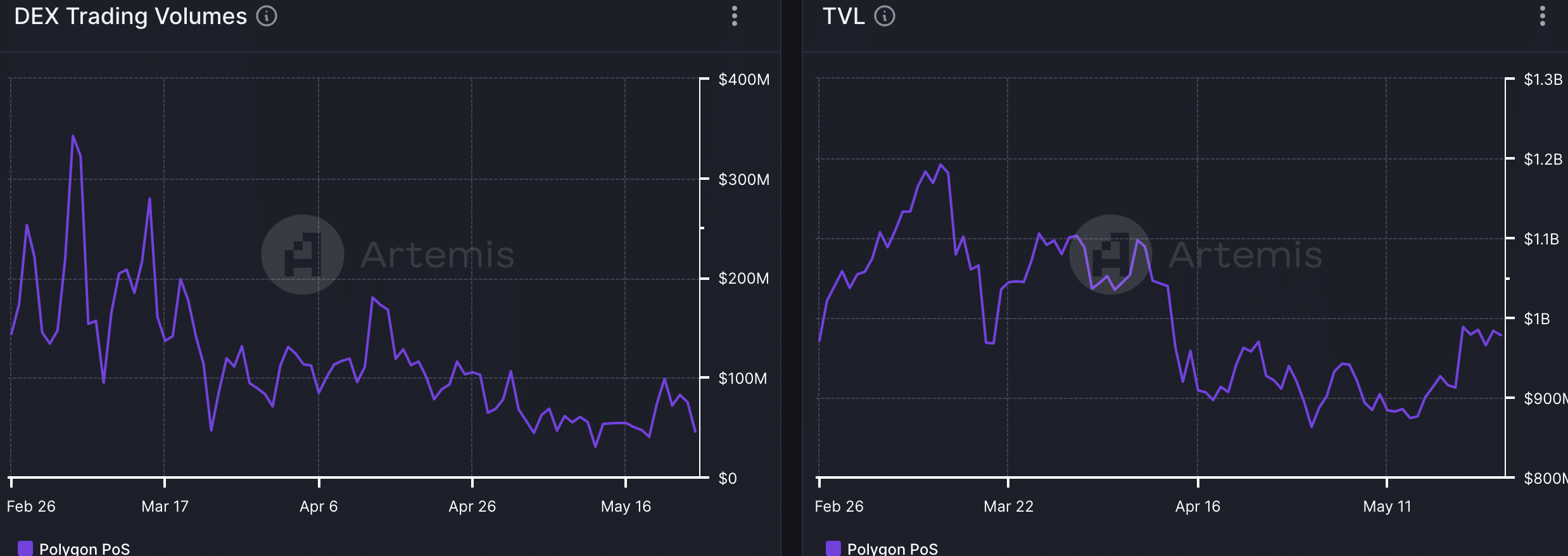

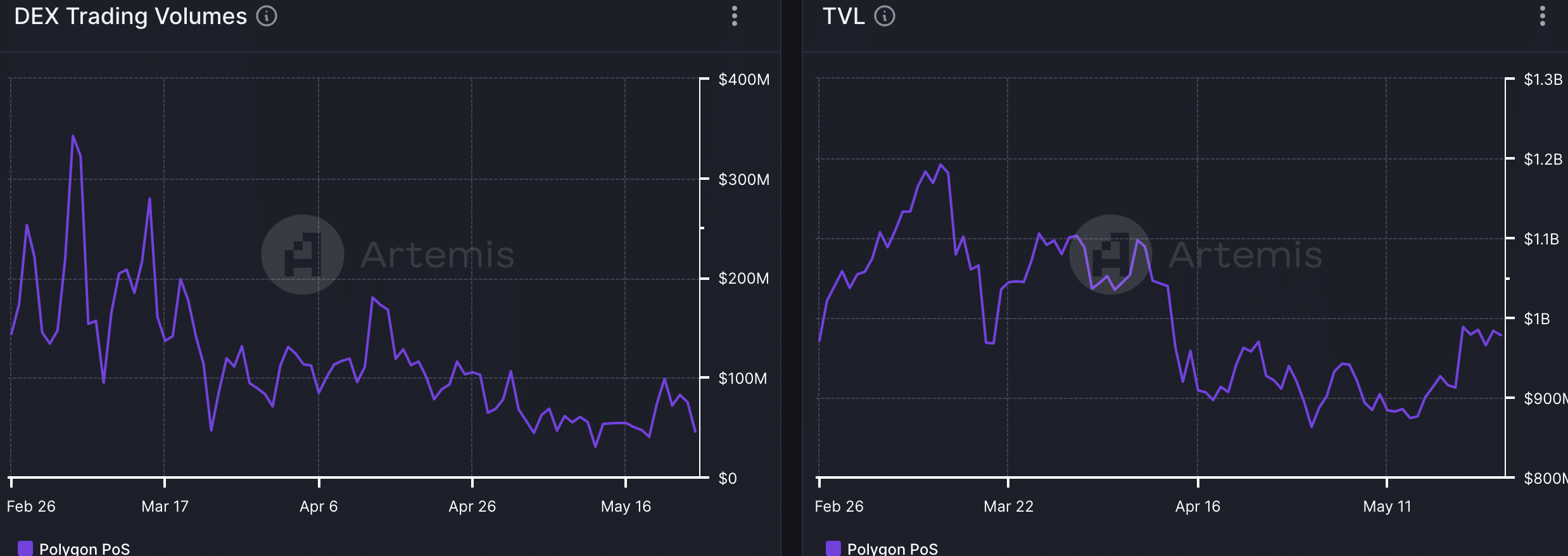

Regardless of this, by way of DeFi, Polygon struggled. General, DEX (Decentralized Volumes) fell from $320 million to $50 million over the previous few weeks.

Furthermore, the TVL (Complete Worth Locked) for Polygon fell considerably from $1.2 billion to $980 million.

Supply: Artemis

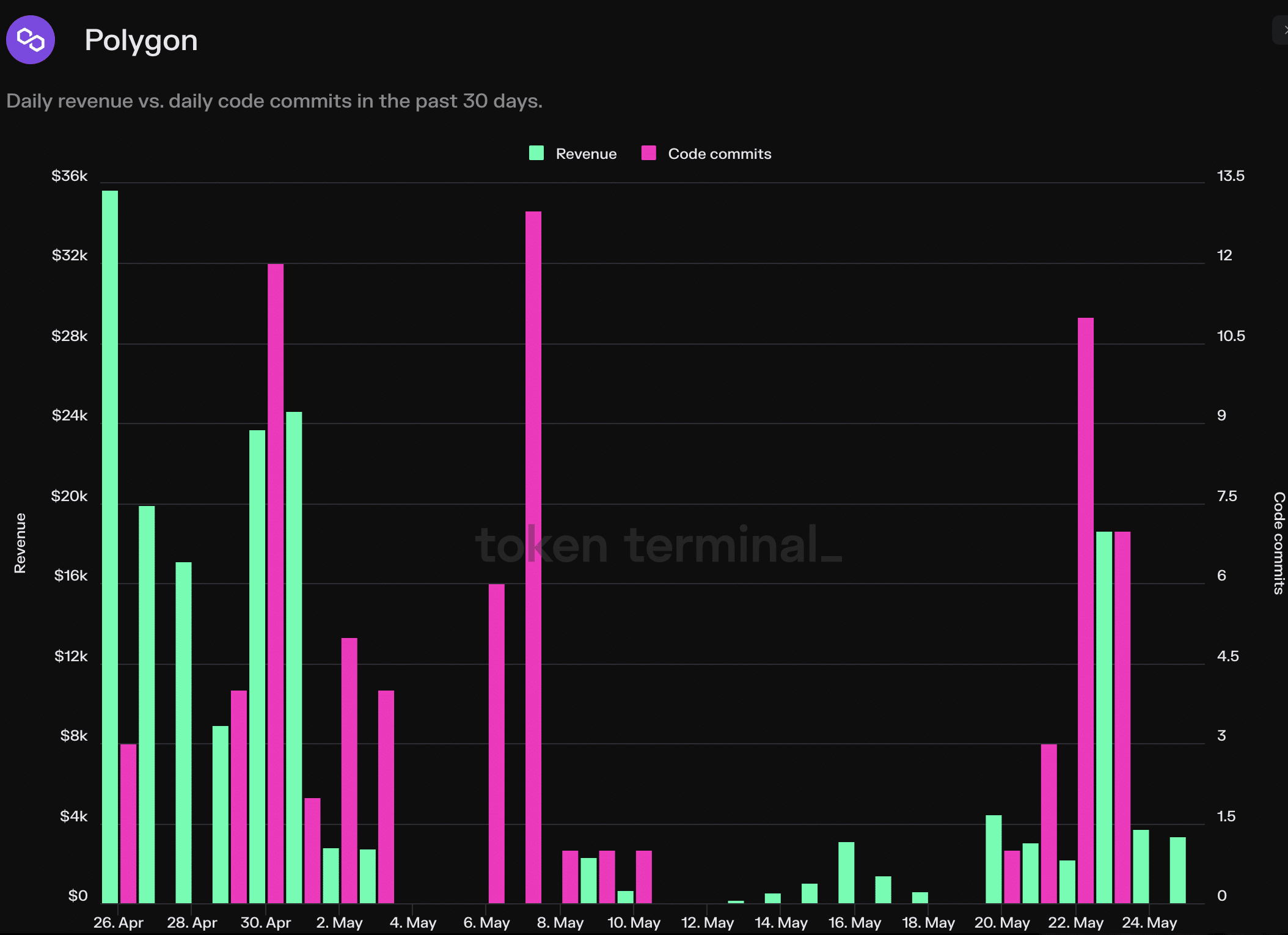

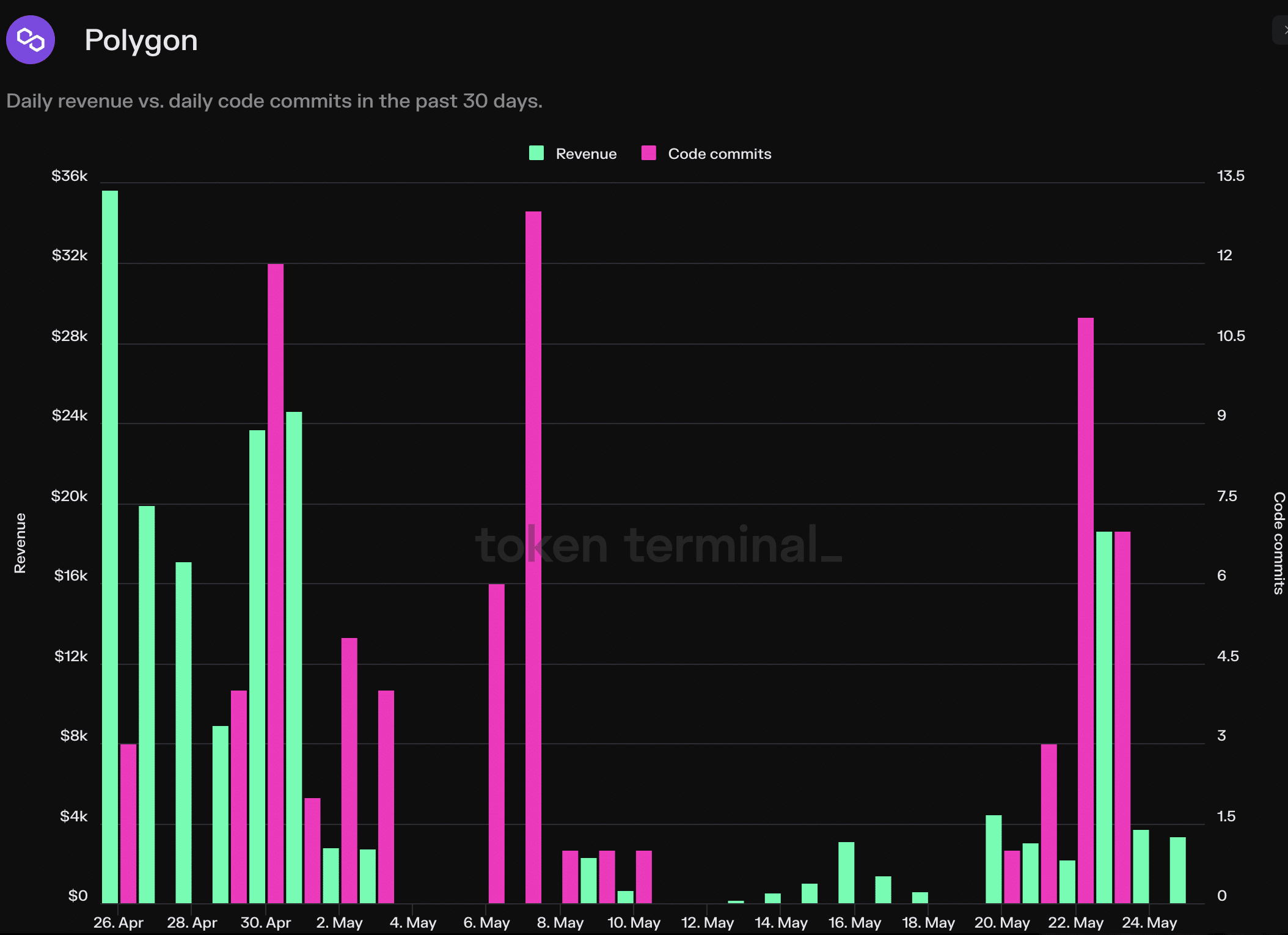

These components impacted the income generated by the Polygon community considerably. AMBCrypto’s evaluation of Token Terminal’s knowledge revealed that the income generated by 42% during the last month.

Likewise, Improvement Exercise fell by 14% n the final 30 days.

Supply: Token Terminal

If the variety of code commits on the community proceed to say no, it could actually have a considerably destructive impression on the Polygon community.

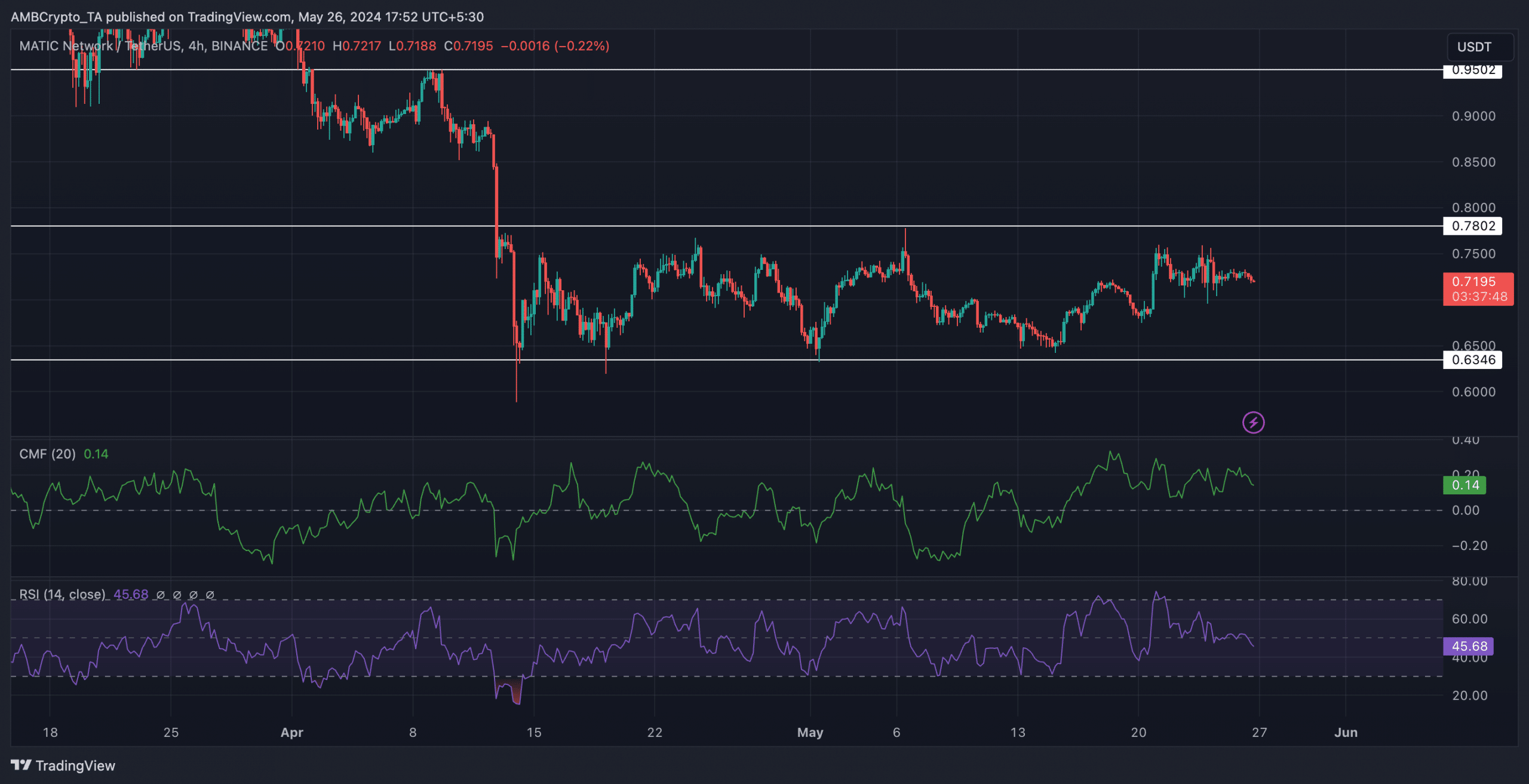

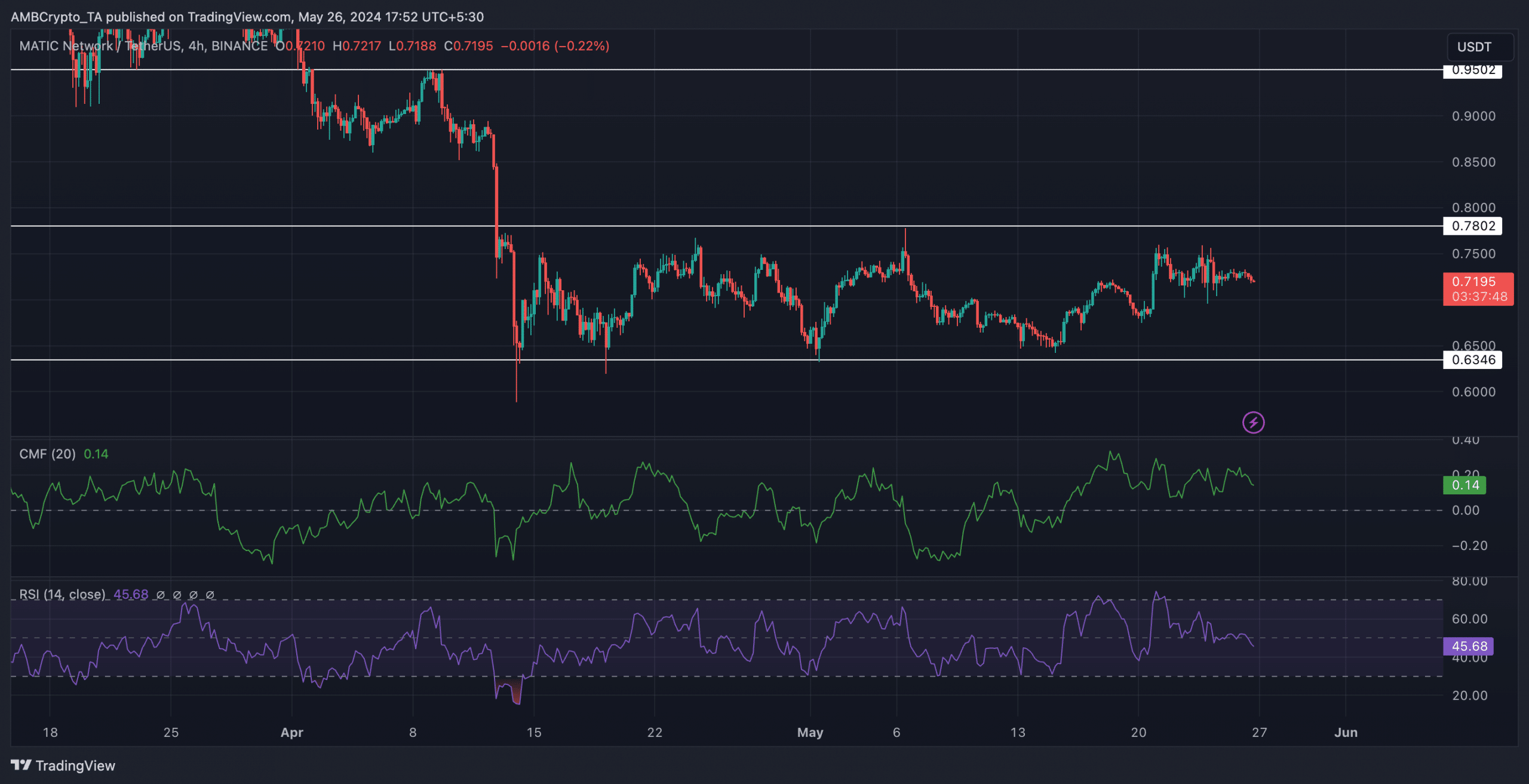

The token did not have a optimistic time by way of value motion as nicely. For the reason that ninth of April, the worth of MATIC declined, exhibiting a number of decrease lows and decrease highs.

This sample advised {that a} bearish development had been established. Regardless of MATIC’s a number of makes an attempt to interrupt the development, the worth remained consolidated between $0.7802 and $0.6346 ranges.

The worth would want to retest and weaken the $0.7802 resistance stage earlier than a reversal will be seen.

The RSI (Relative Energy Index) had fallen materially throughout this era, implying that the bullish momentum round MATIC had weakened.

On the plus aspect, the CMF (Chaikin Cash Stream) had grown, which indicated that the cash flowing into MATIC had surged.

At press time, MATIC was buying and selling at $0.7191.

Supply: Buying and selling View

Lifelike or not, this is MATIC’s market cap in ETH phrases

Holders see inexperienced, token sees pink

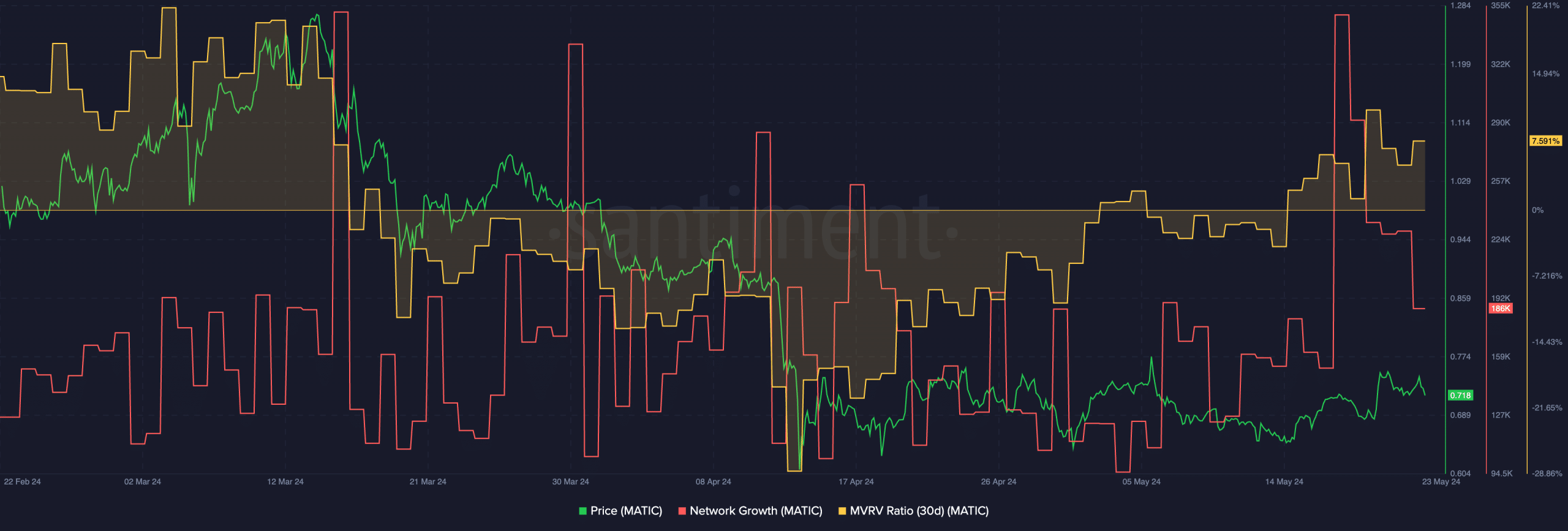

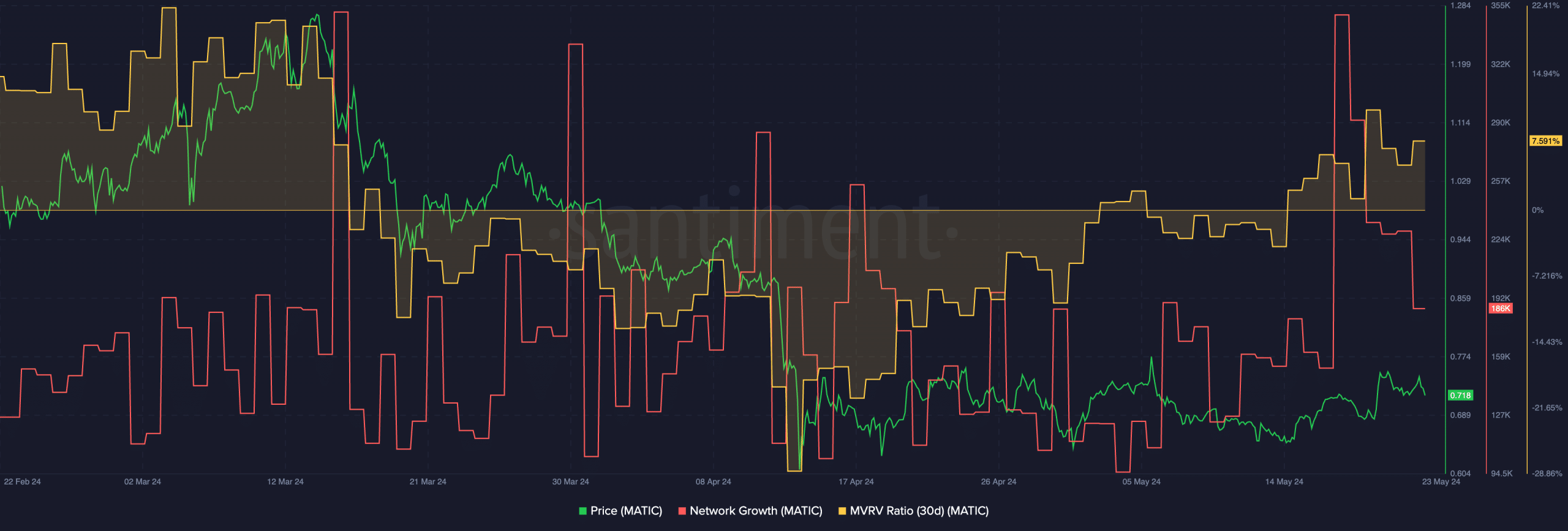

The Community Progress for MATIC had additionally fallen in the previous few days, indicating a scarcity of curiosity from new addresses.

Its MVRV ratio additionally witnessed an increase, which advised that almost all holders had been worthwhile and will have an incentive to promote their tokens additional down the road.

Supply: Santiment