- Solana outperformed Ethereum by way of DEX volumes.

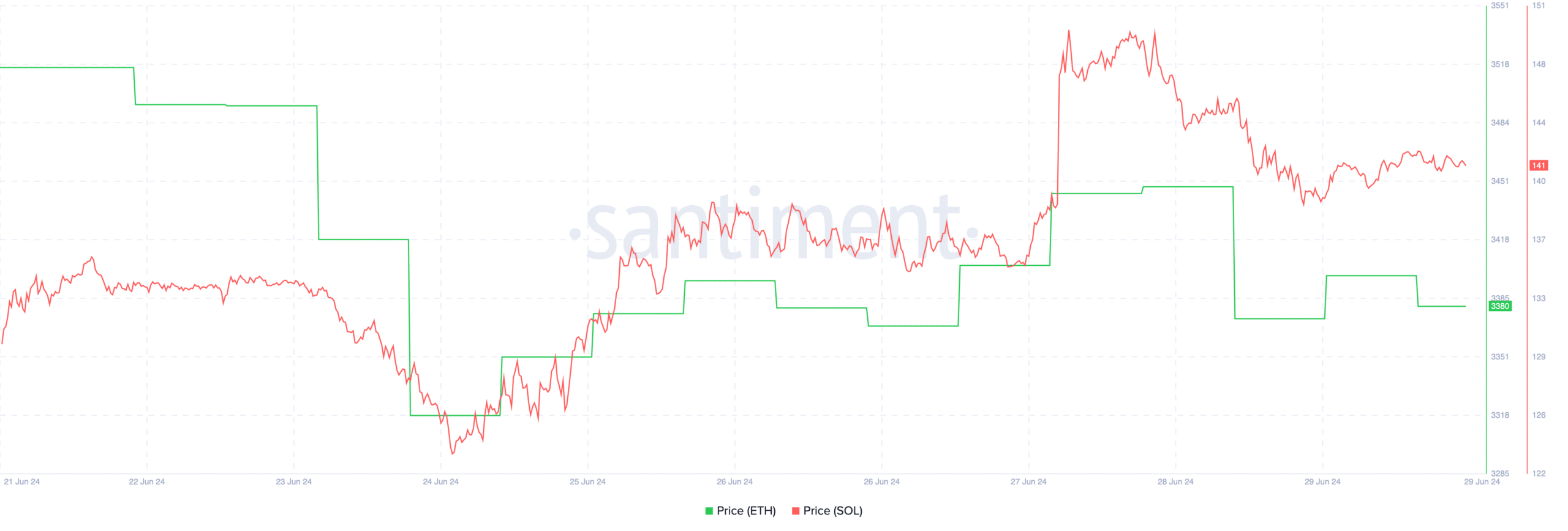

- The worth efficiency of each SOL and ETH tokens had been optimistic over the past 24 hours.

Solana (SOL) and Ethereum (ETH) have been one of many prime cryptocurrency networks within the area.

Despite the fact that Ethereum has managed to retain its dominance in varied areas for essentially the most half, latest developments counsel that Solana may meet up with Ethereum quickly.

Solana reveals promise

Knowledge from DefiLlama confirmed Solana surging forward of Ethereum in each day DEX buying and selling quantity. Solana captured a big lead, processing $1.148 billion in comparison with Ethereum’s $745 million.

This marks a shift in dominance inside the DEX panorama, and will sign a rising choice for Solana’s quicker transaction speeds and decrease charges.

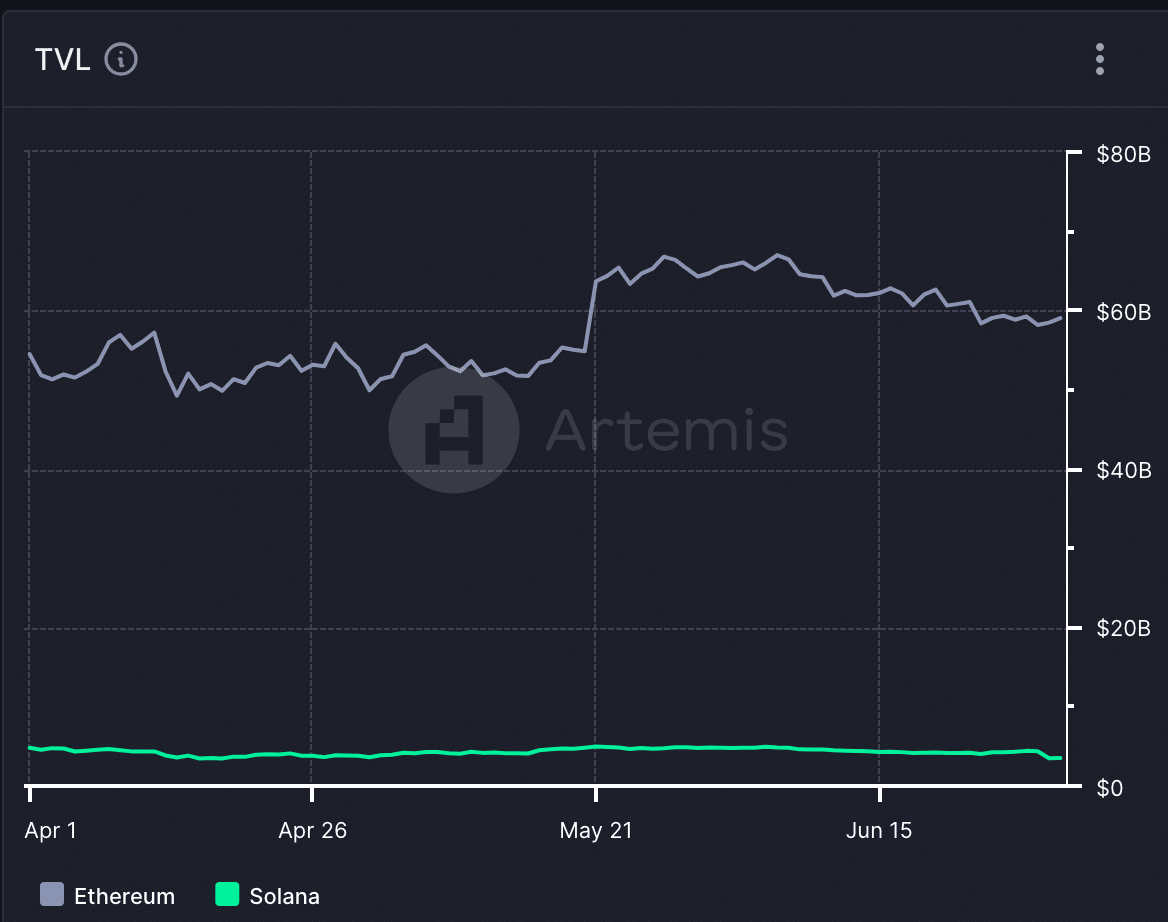

It is price noting that Ethereum stays the chief in total DeFi whole worth locked (TVL), however Solana’s robust exhibiting in DEX quantity may assist propel the protocol to new heights.

Supply: Artemis

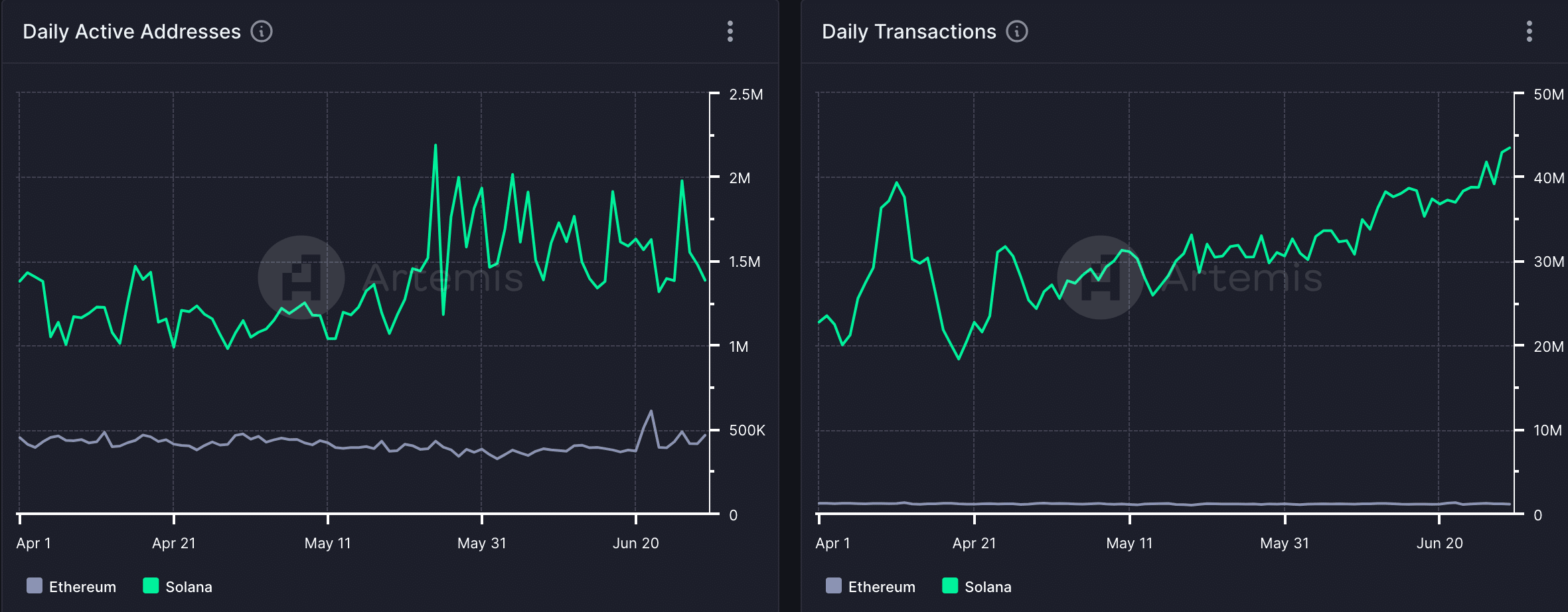

Despite the fact that Solana’s TVL was far behind Ethereum, Solana blew Ethereum out of the water by way of total exercise.

When it comes to each day energetic addresses, the general variety of addresses on Solana had grown to 1.4 million whereas, the variety of each day energetic addresses on the Ethereum community had been 644,000 on the time of writing.

When it comes to each day transactions, Solana confirmed important dominance. On the time of writing, Solana 42.9 million transactions that had been occurring on its community. Whereas on Ethereum, the quantity was round 1.1 million.

Supply: Artemis

Wanting on the finer particulars

Though Solana managed to outgrow Ethereum by way of exercise, you will need to observe that Layer-2s haven’t been considered whereas calculating exercise.

L2s like Arbitrum (ARB) and Optimism (OP) act as scaling options for Ethereum, processing transactions off the mainnet however nonetheless leveraging Ethereum’s safety.

Exercise on these L2s interprets to curiosity within the Ethereum ecosystem as an entire.

Nevertheless, Solana’s spectacular numbers elevate questions on long-term sustainability.

The excessive transaction quantity is perhaps partly pushed by speculative exercise or meme coin buying and selling, which can not translate into long-term worth creation.

It is essential to see if this exercise interprets into constructing strong DeFi purposes and attracting established tasks.

Furthermore, Solana’s structure boasts quicker speeds and decrease charges, but it surely has confronted criticism relating to community congestion and outages previously.

Is your portfolio inexperienced? Take a look at the SOL Revenue Calculator

If outages proceed to happen on the Solana community, it may totally influence the sentiment round Solana community and will steer some customers away from the protocol.

At press time, each SOL and ETH tokens had benefited from the latest bullish sentiment rising within the crypto markets and grew by 6.6% and three.4% respectively within the final 24 hours.

Supply: Santiment