- Uniswap postponed a much-anticipated proposal meant to enhance its token governance.

- The value of the UNI token received impacted considerably and fell by 5%.

Uniswap (UNI) has needed to delay a extremely anticipated proposal geared toward enhancing its token governance and price distribution mannequin.

governance points

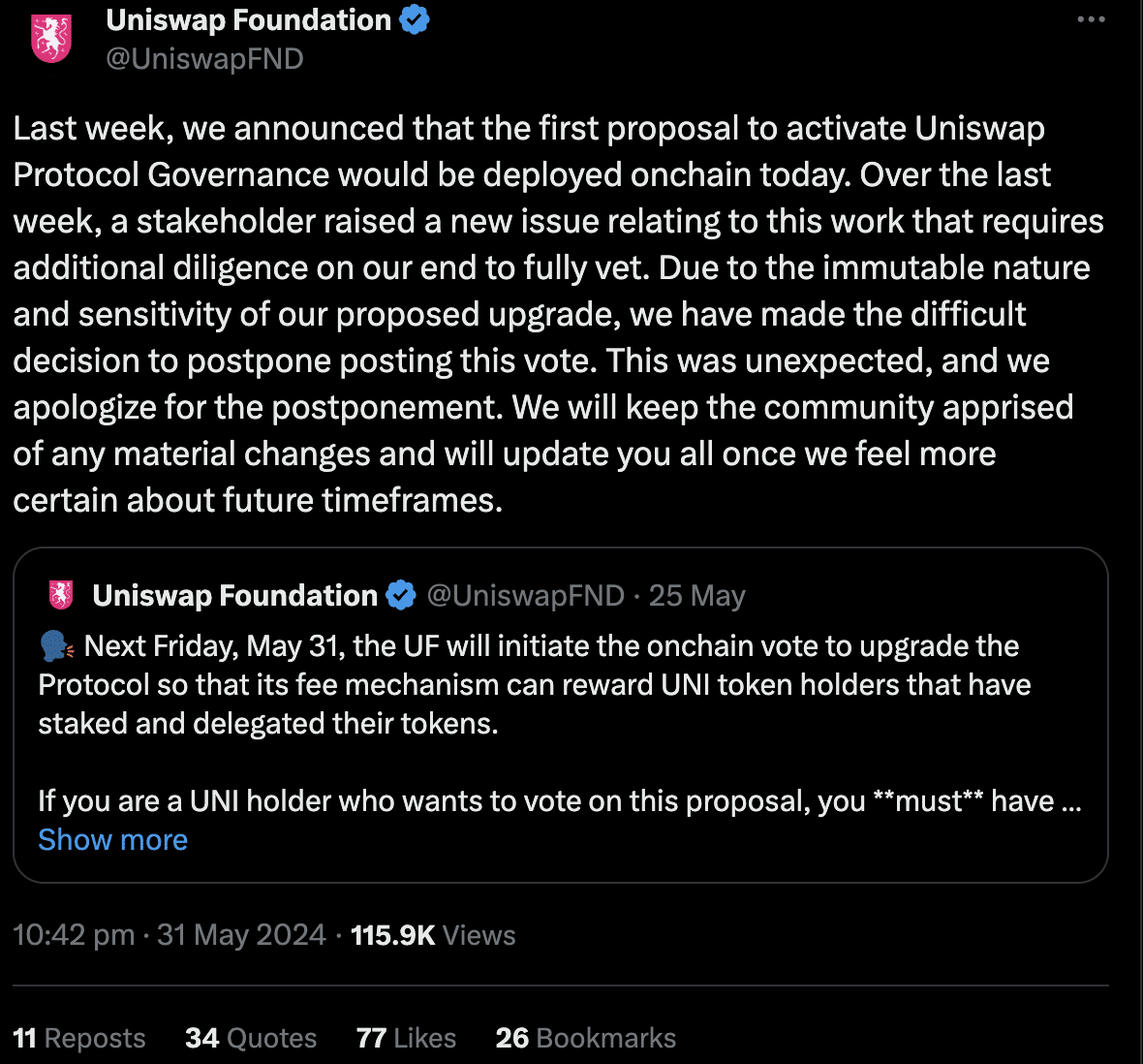

The Uniswap Basis introduced this delay within the deployment of the primary proposal to activate Uniswap Protocol Governance.

The muse emphasised the necessity for extra due diligence as a result of a brand new subject raised by a stakeholder, highlighting the sensitivity of the proposed improve.

They acknowledged the surprising nature of the postponement and apologized, assuring the neighborhood that they might learn of any important modifications and up to date as soon as there was extra certainty about future timelines.

The postponed proposal aimed to streamline Uniswap’s price mechanisms, enabling UNI token holders who’ve staked and delegated their tokens to obtain rewards.

It sought to enhance the effectivity of price changes and cut back the governance burden on delegates whereas sustaining the protocol’s credible neutrality.

Supply: X

How is UNI doing?

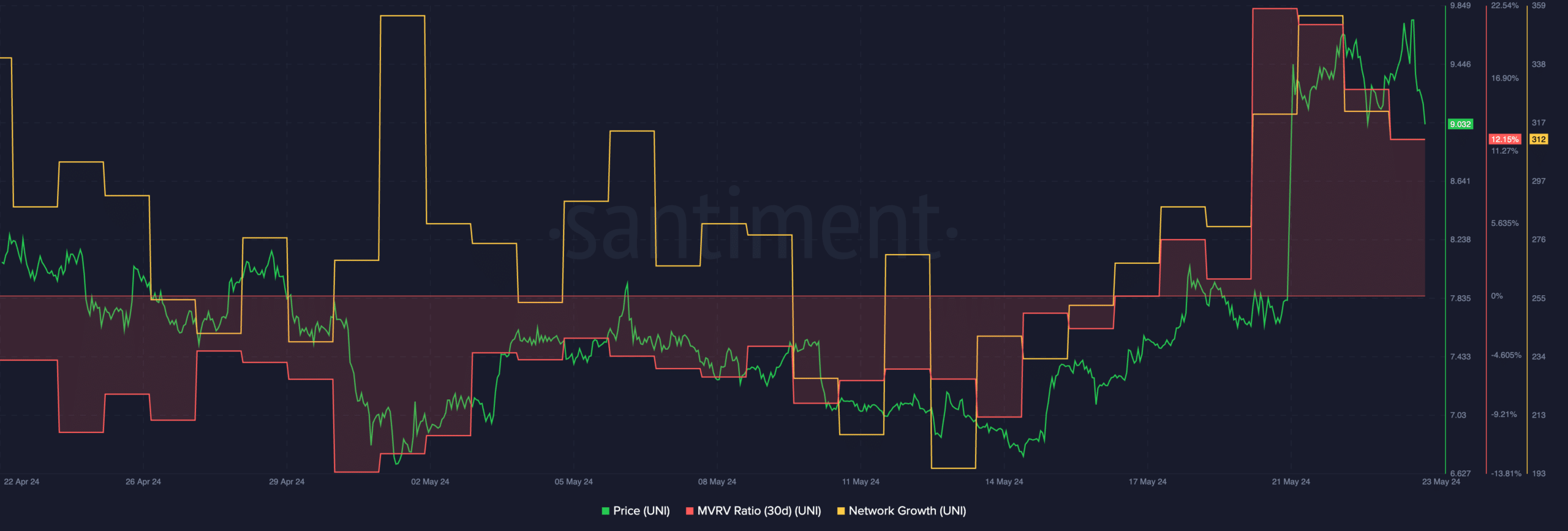

The UNI token took a big hit as a result of this announcement and fell by 5% over the past 24 hours. The quantity at which UNI was buying and selling at had grown by 32% throughout this era.

Regardless of the numerous decline in worth, many of the UNI holders remained worthwhile. This was indicated by the MVRV ratio of UNI that was constructive regardless of the worth corrections.

The excessive profitability of those addresses may assist preserve constructive sentiment across the UNI token.

Supply: Santiment

Authorized troubles ensue

Including to Uniswap’s challenges, the corporate was additionally going through a authorized battle with the SEC. The regulatory company issued a Wells Discover to Uniswap Labs, indicating its intent to suggest enforcement motion towards the agency.

Uniswap Labs contested the SEC’s case, arguing that it’s flawed and fails to distinguish between tokens as shops of worth and tokens as securities.

Lifelike or not, this is UNI’s market cap in BTC’s phrases

The group at Uniswap expressed confidence in a good consequence, noting its authorized group’s robust monitor file towards the SEC.

Their authorized group contains Andrew Ceresney, who represented Ripple of their victory over the SEC, and Don Verrilli, a former US solicitor common who has argued greater than 50 instances earlier than the US Supreme Court docket and represented Grayscale in its profitable case towards the SEC.